Fewer people are taking out mortgages as interest rates increase

Published 9:00 pm Friday, February 17, 2023

wutzkohphoto // Shutterstock

Fewer people are taking out mortgages as interest rates increase

Americans are taking out fewer mortgage loans as interest rates increase, a reflection of buyer uncertainty amid rising inflation, higher interest rates, and concerns about economic slowdowns. And even as mortgage rates hover near highs not seen in 20 years, mortgage amounts have yet to fall back to pre-pandemic levels.

Experian examined mortgage rate data and the number of new mortgages in the U.S. to see how rising interest rates affect potential homebuyers. This analysis looked at the number of mortgages made for all types of first-lien mortgages through the third quarter (Q3) of 2022.

Mortgage rates measure the interest that a lender charges, expressed as a percentage of the loan amount. Fixed-term conventional mortgage rates are determined using many factors, including the overall health of the economy and the federal funds rate. The Federal Reserve usually raises interest rates in times of strong economic growth and as a means of mitigating inflation.

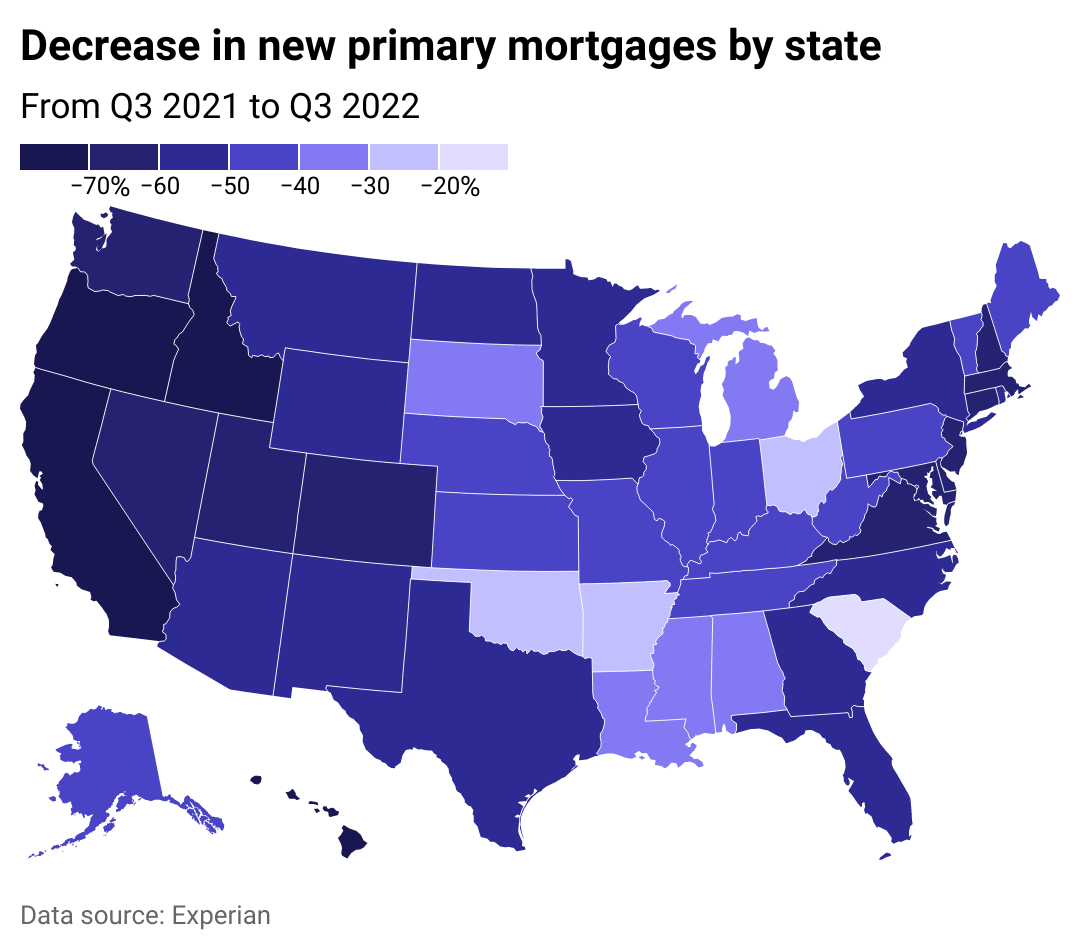

The number of mortgages issued in the U.S. fell 62.3% in Q3 2022 compared to the same period the year before, according to Experian. Mortgage counts fell the most in Western states, including Oregon, California, and Idaho. And in addition to the number of mortgages issued dropping, the median loan amount per borrower in the U.S. fell to $295,000 in October 2022—lower than it’s been since January 2021.

To understand the changing mortgage market, it’s important to also understand the unprecedented ups and downs of the housing market over the past few years. At its onset, the COVID-19 pandemic slowed homebuilding drastically. And even though the construction industry kicked into high gear as pandemic restrictions eased across the country, supply remained constricted. Issues in the complex network of building materials suppliers worldwide, as well as natural disasters and a shortage of truck drivers and transportation, limited how quickly builders could move ahead.

And even as construction activity recovered, demand for homes far outstripped the available supply. Driven by a desire for more space—and low interest rates meant to spur economic recovery from the COVID-19 recession—eager would-be home buyers jumped into the market. Joining them were flippers, institutional investors, and corporations that were often locked into fierce competition for the housing stock available.

As inflation and interest rates began to increase steadily starting in early 2021, overheated market prices cooled down. Fewer potential buyers are entering the market, homes are taking longer to sell, and it remains to be seen if mortgage loan originations will continue to fall—and by how much.

![]()

Experian

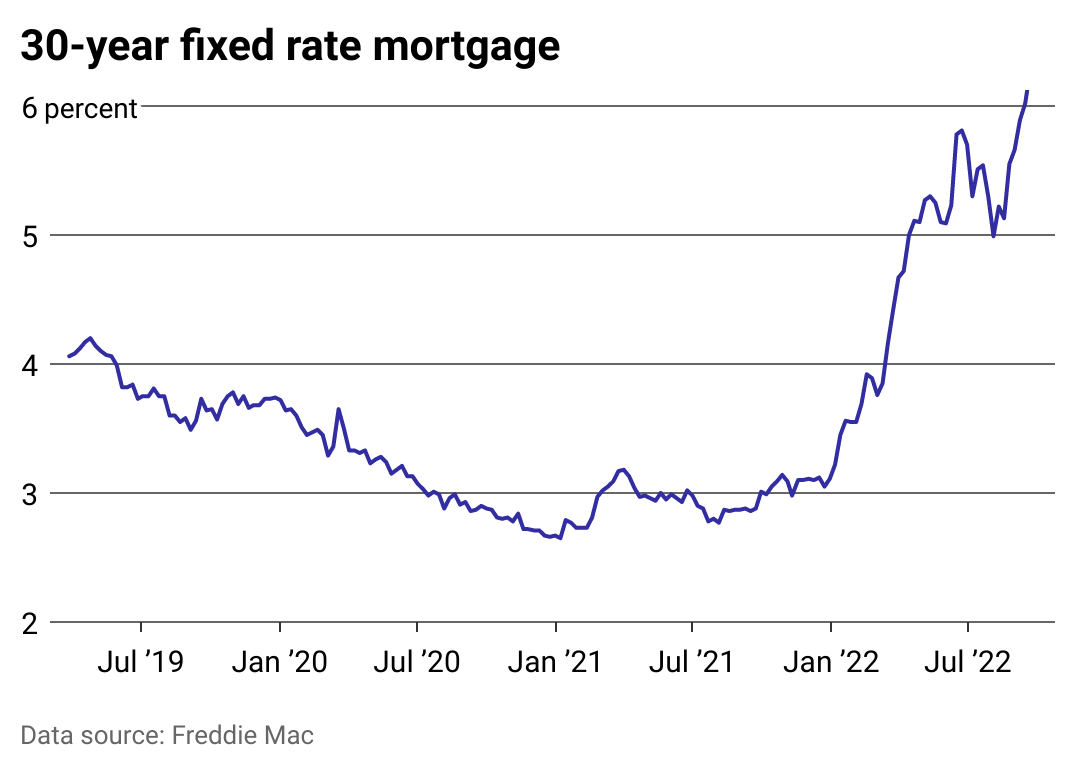

Mortgage rates surpass pre-pandemic levels

As interest rates climb, so too does the overall cost of a house since more interest will be paid to the lender—not to the principal on a loan—over time. As a result, those rising rates can make financing a house significantly more challenging for buyers. Not only that, the interest rate on fixed-rate mortgages stays the same over the life of the loan, which means monthly payments will remain unchanged if rates fall in the future unless the homeowner refinances.

Rates have risen rapidly this year, with average mortgage rates nearing 6% in June 2022, resulting in what one researcher called “a shock to the system.” Just a few months later, In October 2022, the average 30-year fixed-rate mortgage interest rate passed 7% for the first time in 20 years, according to Freddie Mac. Average rates have dipped slightly as of the time of publication, but with the Fed signaling that it’s likely to continue raising the federal funds rate into 2023, that trend may not continue.

Experian

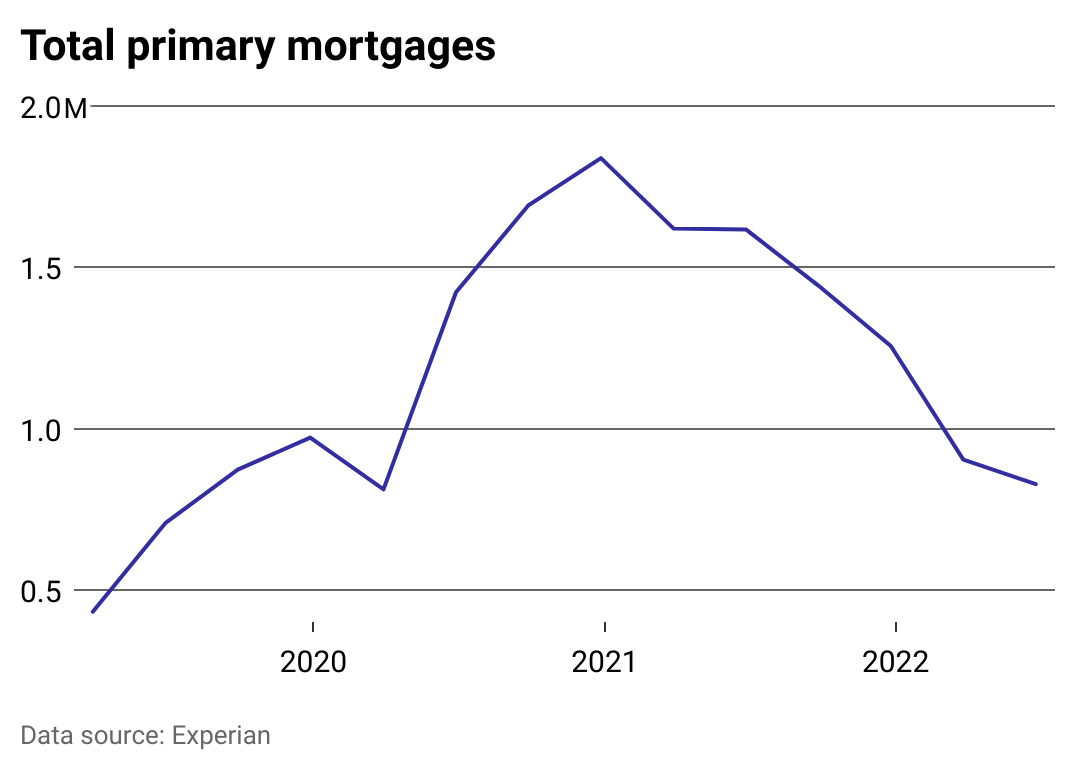

Mortgages take a hit

The number of primary mortgages originated by lenders has seen a notable decline. Potential homebuyers, spooked by higher interest rates and talk of rates going far higher, began backing away from the housing market as early as April, some mortgage brokers have said.

Over the past decade, many homebuyers have locked in interest rates lower than the current average, which makes today’s market less appealing for many. Rather than settling for a smaller home in a less desirable area, some homebuyers are waiting for interest rates to drop so they have more purchasing power. For other buyers, rising interest rates have priced them entirely out of the market.

Higher interest rates also mean there is very little incentive for a typical homeowner to sell—even if the home sold at a profit, the seller would then need to finance a new house at a higher interest rate, which could cost considerably more month-to-month than they likely were paying on their old home.

Experian

How states compare by biggest drops in mortgage activity

From September 2021 to September 2022, the number of new mortgages decreased in all 50 states and Washington, D.C. Oregon saw the greatest fall off with the number of new mortgages plunging 82%. Following close behind were Western neighbors California and Idaho. Meanwhile, a concentration of states along the Eastern seaboard including New Hampshire, Virginia, and New Jersey saw declines as high as 74%.

Turhan // Shutterstock

Overall mortgage debt swells—then declines

The National Bureau of Economic Research found that the shift to remote work was one of the main drivers of increased property values from 2019 to 2021 as workers sought larger, more affordable homes farther away from urban centers.

But as new mortgage amounts steadily dropped in 2022, the steep climb in overall costs to finance a house reflects not just the record increases in home values seen in the last three years, but also the effects of the Fed’s interest rate hikes. Of course, as interest rates increase, a greater portion of the mortgage payment goes toward interest and not toward paying off the principal of the home’s value.

With less competitive rates and higher cost of ownership, potential homebuyers opted out of the market by Q3 2022. The amount of new primary mortgage loans dropped 37% compared to Q3 2021, and even fell 13% below pre-pandemic figures in Q3 2019.

This story originally appeared on Experian and was produced and

distributed in partnership with Stacker Studio.