How eviction levels have grown in 11 major cities

Published 2:00 pm Tuesday, May 2, 2023

Canva

How eviction levels have grown in 11 major cities

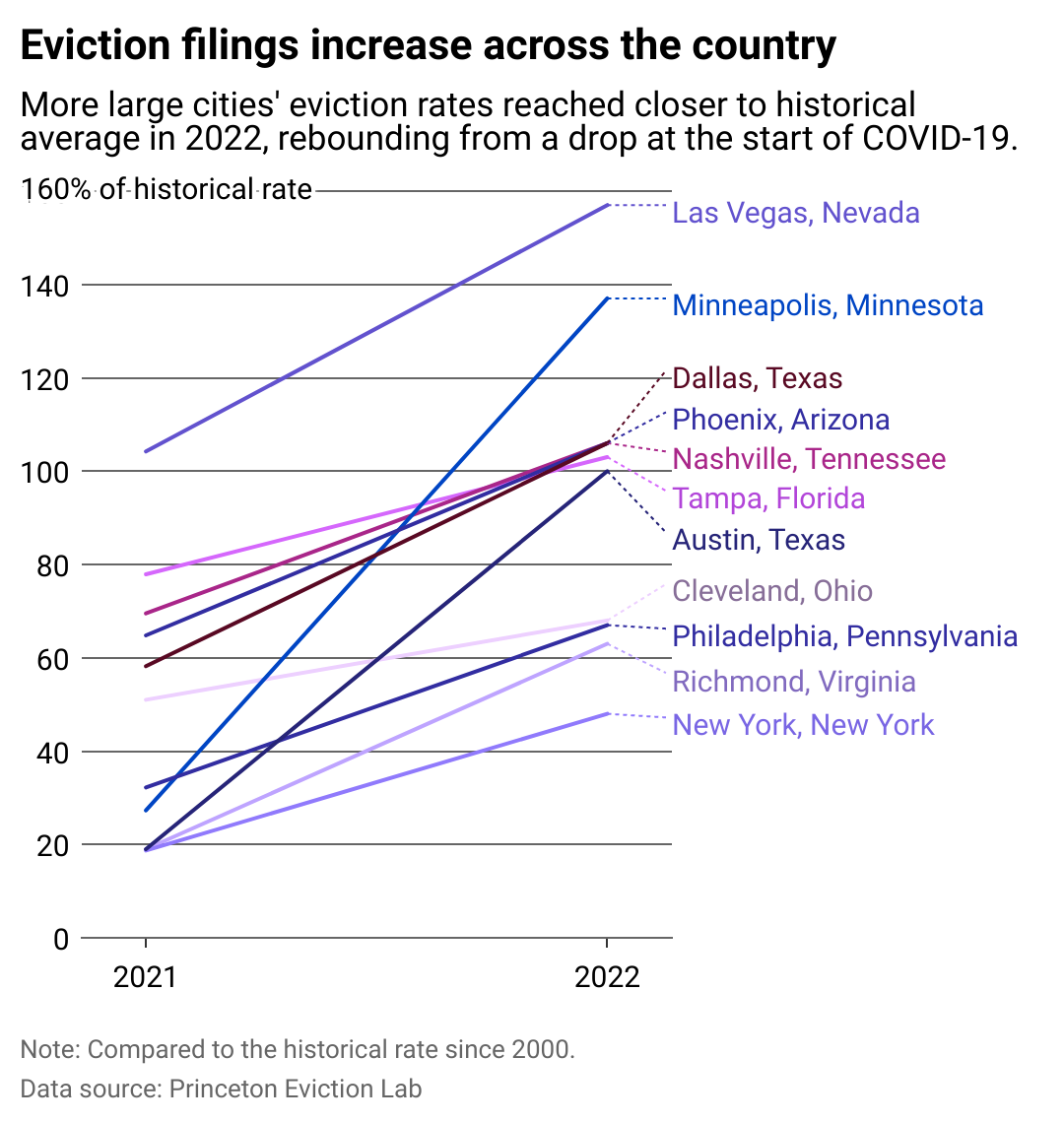

In 2022, a handful of large U.S. cities saw landlords remove renters from homes at rates that surpass the typical pre-COVID-19-pandemic rate, according to a new report from the Eviction Lab at Princeton University.

Belong used data compiled by the Eviction Lab to compare how eviction levels changed in 11 major U.S. cities in 2022. The cities are sorted by the change in eviction filings relative to the historical average from 2021 to 2022. Not every U.S. city was considered in this analysis due to the lack of comprehensive, current data. It looks at a geographically diverse cross section of cities with populations of 1 million or more and should not be viewed as a comprehensive ranking.

Unlike other kinds of housing data real estate agents and other professionals consult and trade daily, eviction data is not easy to obtain. Historically, the data has resided with thousands of local governments where evictions occur. There are few places where that data has been made readily available online until now.

Through its data collection, the Eviction Lab gives the American public a peek into a part of public life that has not always been made public—tracking eviction filings in 34 cities with the help of organizations on the ground in those communities. An eviction filing is the legal document created when a landlord files a case in court to have a tenant removed from their property.

Eviction rates rose in all 32 cities tracked by the Eviction Lab in 2022. The eviction rate in this analysis refers to the number of evictions per 100 rental properties in a given area. In all, landlords in these places filed about 970,000 eviction cases, up 79% compared to the year before.

The increase comes after a period of unprecedented federal housing protections for renters.

The pandemic did something no economic catastrophe in recent history has—it convinced legislators to enact sweeping national policies that materially lowered the rate of evictions.

For roughly 1.5 years, the country maintained the strongest safeguards for keeping renters housed in recent history. In September 2020, the Centers for Disease Control and Prevention imposed a federal eviction moratorium, which was essentially a ban on evictions under most circumstances, including failure to pay rent, as a measure to protect public health by preventing the spread of COVID-19. The disease spreads more quickly when people are forced to live in close quarters or share housing with friends, family, or strangers at a homeless shelter or other group housing.

The federal government also allocated billions in rental assistance dollars for tenants as part of the bailout packages passed to help Americans weather the economic effects of the pandemic.

Those measures, however, were temporary and elicited concern from landlords who said it tied their hands when trying to remove problematic tenants. Proponents argued that with so much aid money being made available, there was no need to remove tenants. But only the most progressively aligned members of Congress were willing to continue pushing for a continuation of the policy, which began under former President Donald Trump’s administration but was struck down by the Supreme Court in August 2021.

Housing advocates warned that a wave of evictions would emerge as localities rescinded their respective eviction moratoriums following the Supreme Court decision. That wave, however, failed to materialize in the final months of 2021.

Still, data from select cities in 2022 shows evictions did surge in some places shortly thereafter.

And economic conditions continue to become more difficult following the initial few waves of COVID-19 infection in the U.S. Historic inflation reared its head in late 2021 and has burned through Americans’ purchasing power in the years since—with housing costs rising particularly sharply.

![]()

Belong

Evictions on the rise

Las Vegas; Minneapolis; and Austin, Texas have seen eviction filing rates increase the most of the large cities analyzed. The cities that have seen rates grow most steeply are also housing markets that were incredibly popular amid the hot pandemic housing market. Some of those markets have seen home prices drop since late 2022 after property values climbed unnaturally high in just two years.

Canva

Cleveland, Ohio

– Eviction filings, 2022: 67.7% of historical average (16.7 percentage-point growth from 2021)

One year after the federal eviction ban fell, Cleveland City Council passed a new law making it so that tenants can avoid being removed from a property if they pay the full past-due balance on their unit before a court hearing. The law also allows them to continue living in the unit while awaiting disbursement of rental aid if they’ve been granted any assistance. Distribution of rental assistance has been slow in some parts of the country, causing frustration for landlords and tenants alike.

Canva

Tampa, Florida

– Eviction filings, 2022: 103.2% of historical average (25.3 percentage-point growth from 2021)

Florida Gov. Ron DeSantis signed a new affordable housing bill into law in March 2023, which critics have argued won’t help renters. The law drew condemnation from tenants’ rights groups along the Florida Gulf Coast for banning the local government’s ability to impose rent control. The state has consistently been one of the fastest-growing in terms of population—a trend that only continued as property values skyrocketed over the pandemic.

Canva

New York, New York

– Eviction filings, 2022: 48.0% of historical average (29.3 percentage-point growth from 2021)

After a brief moment of panic in 2020 as New York City became the epicenter of COVID-19 spread on the East Coast, living costs have increased in New York at a breakneck pace. Throughout 2022, renters were getting hit with rent increases that amounted to 20% to 30% more than the year prior. These hikes spurred lawmakers this year to consider enacting new rent control laws that would keep landlords from hiking rental rates more than 3% and would affect an estimated 1 in 2 renters in the state.

Canva

Philadelphia, Pennsylvania

– Eviction filings, 2022: 67.3% of historical average (35.1 percentage-point growth from 2021)

A recently released research report from Cornell University looked at studies in Philadelphia and other comparably populated cities and found a link between communities that had higher eviction rates and increases in crime as well as lower voter participation in elections.

The city’s eviction diversion program was highlighted in recent years as a model for other cities, having helped prevent unnecessary evictions of residents. Recent reporting has found thousands of Philadelphia residents spend more than half of their income on rent alone.

Canva

Nashville, Tennessee

– Eviction filings, 2022: 106.2% of historical average (36.7 percentage-point growth from 2021)

Nashville’s workforce has benefitted from a surge in new residents moving there in recent years as Americans sought lower costs of living and took advantage of their newfound flexible work freedoms. At the same time, housing costs have risen in the metro area, prompting the city council to consider a bill that would create a new online affordable housing tracking dashboard.

Canva

Phoenix, Arizona

– Eviction filings, 2022: 105.6% of historical average (40.8 percentage-point growth from 2021)

New residents moving to the state have far outpaced the rate at which new housing is being built in Arizona. Phoenix’s cost of living has been rising so rapidly that leaders have worried about the middle class falling into poverty. A SmartAsset study found that an Arizonan needed to make $90,000 annually before taxes to afford to live there comfortably today.

Canva

Richmond, Virginia

– Eviction filings, 2022: 63.3% of historical average (44.3 percentage-point growth from 2021)

The high cost of living in the nation’s capital has sent workers seeking more affordable living options in metros further away from Washington D.C., including Richmond. Its population grew faster than northern Virginia’s population from 2020 to 2022, according to a study from the University of Virginia.

Canva

Dallas, Texas

– Eviction filings, 2022: 106.4% of historical average (48.2 percentage-point growth from 2021)

The large-scale movement of Americans migrating to Texas over the last two decades was driven by corporate relocations as much as a natural interest in lower costs of living. That cost savings factor may be disappearing, though, experts are warning. And it’s mostly due to the lack of affordable housing options in the state. Dallas was short almost 100,000 homes for its low-income population, according to a recent study from the Texas Real Estate Research Center at Texas A&M University.

Canva

Las Vegas, Nevada

– Eviction filings, 2022: 157.2% of historical average (53.0 percentage-point growth from 2021)

Like many cities, Las Vegas is plagued by a shortage of homes priced affordably for a large portion of its population. Low housing inventory has pushed up prices, including in the rental market. The Nevada State Apartment Association issued a report in early 2022 that found that rent jumped more than 20% over the same time the year before.

Canva

Austin, Texas

– Eviction filings, 2022: 99.8% of historical average (80.8 percentage-point growth from 2021)

Austin has been battling a burgeoning homelessness crisis—sometimes compared to that of San Francisco—for the last several years. An influx of wealthy residents and tech workers has driven housing costs in Texas to unaffordable levels for many employed in the service industry and other nontech jobs. Austin’s cost of living today ranks above the national average, mostly because of higher housing costs.

Canva

Minneapolis, Minnesota

– Eviction filings, 2022: 137.4% of historical average (110.1 percentage-point growth from 2021)

Minneapolis tops this ranking with the largest surge in evictions in 2022 compared to the average pre-pandemic eviction rate. That’s even as city leaders celebrated bringing triple the usual number of affordable housing units into the market in 2022. Consumer prices rose faster in 2022 than the national average in Minneapolis and its “twin” city, St. Paul.

This story originally appeared on Belong and was produced and

distributed in partnership with Stacker Studio.