Higher ed experts foresee enrollment decline due to botched FAFSA rollout

Published 8:15 pm Monday, May 13, 2024

Higher ed experts foresee enrollment decline due to botched FAFSA rollout

The botched launch of the 2024-25 Free Application for Federal Student Aid (FAFSA) may lead to a precipitous drop in college enrollments for the upcoming school year that could surpass those reported following the COVID-19 pandemic, according to higher education experts and advocates.

MorraLee Keller, senior director of strategic programming at the National College Attainment Network (NCAN), told BestColleges that the country should brace for the worst but hope for the best.

“We may be in for a very drastic change,” she said about the enrollment impact. “We’re on a path that could leave us 10%-15% behind last year.”

Lawmakers and panelists representing higher education stakeholders echoed Keller’s concerns in a hearing of the U.S. House Subcommittee on Higher Education and Workforce Development held April 10. Many testified that continued FAFSA issues may leave hundreds of thousands of students deciding to forgo college for the 2024-25 academic year.

“This dark reality directly opposes the intended purpose of the [FAFSA] Simplification Act, serving as a slap in the face to students wanting to be somebody and achieve the promise of higher education,” Rep. Frederica Wilson, a Democrat representing Florida, said during the hearing.

Panelists also expressed mounting frustration with how the Department of Education (ED) has navigated this crisis.

FAFSA Completions Lag Previous Years

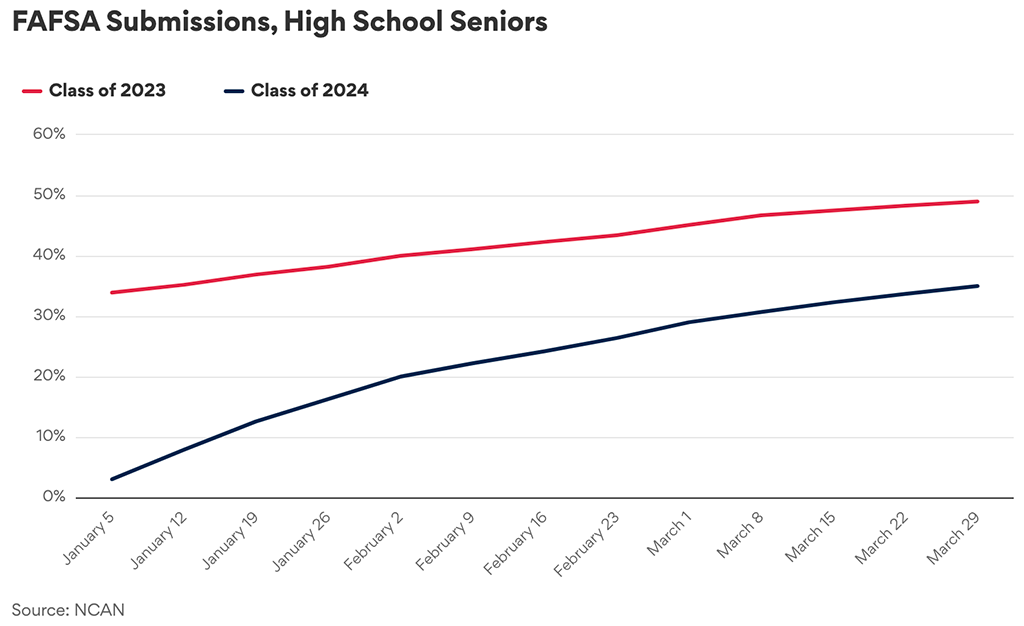

NCAN’s FAFSA Tracker paints a bleak picture of this year’s FAFSA cycle.

Through March 29, an estimated 35% of soon-to-graduate high schoolers had submitted a FAFSA. That’s a 27.1% decrease from the same time last year and a difference of over 541,000 students.

![]()

BestColleges

Submissions Are Down for the Class of 2024

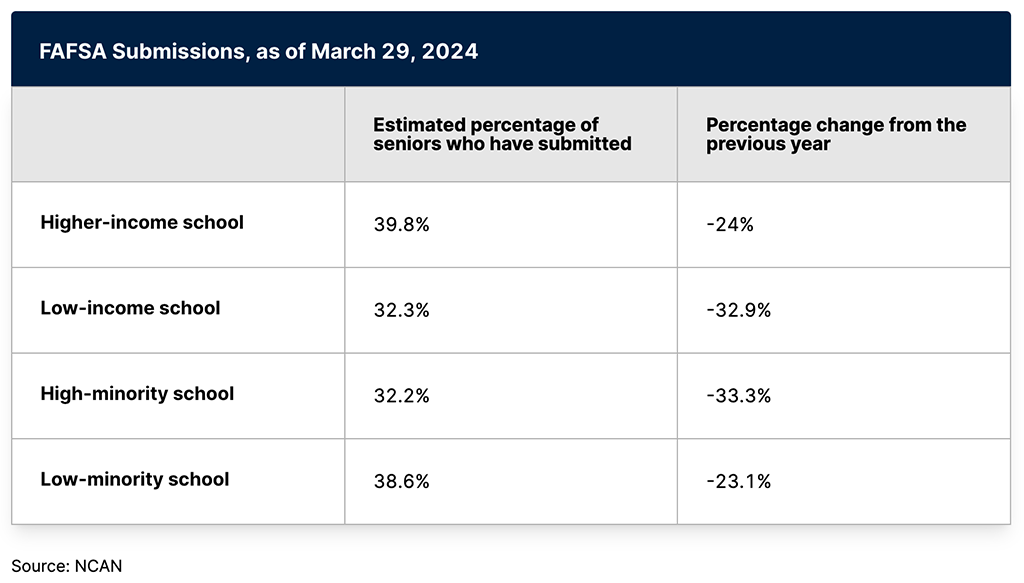

Declines are even more pronounced for students coming from low-income or high-minority schools.

BestColleges

Numbers Lag in These Demographic Categories

The implication is that without a drastic change in the coming months, it’ll be low-income students and those from underrepresented backgrounds who will suffer the most from FAFSA issues.

Keller expressed extreme doubt that submissions and completions will ever reach 2023-24 levels.

“Do I see a universe where we surpass that completion rate?” she asked. “I just don’t.”

Known processing or data errors potentially affect 30% of submitted FAFSAs, ED said, and 16% require a student correction.

Enrollment Drop-Off Imminent

Panelists at the House hearing agreed that it’s not a question of whether FAFSA issues will cause an enrollment drop, but how much will enrollment decline.

In his opening remarks, Republican Rep. Burgess Owens of Utah floated the possibility of a 20% drop in enrollment. Keller told BestColleges she predicts something closer to 10%-15%.

Both declines are more severe than those seen following the COVID-19 pandemic.

These predictions come because FAFSA completion correlates with a student enrolling in college.

Kim Cook, CEO of NCAN, said during the House hearing that students are 70% more likely to enroll in college the following semester if they complete a FAFSA, as the application makes them eligible for federal, state, and institutional financial aid.

As delays stretch on, some worry students may forgo enrolling in college this fall altogether.

Decision Day is typically May 1 for most universities. Rachelle Feldman, vice provost of enrollment at the University of North Carolina (UNC) Chapel Hill, said during the hearing that her institution would normally have sent all financial aid award letters to accepted students by the end of March, giving them a full month to weigh their options and choose.

Now, she said she hopes to send award letters by the first week of May, but that’s not a guarantee.

That means even for schools that extended their decision deadline to June 1 — which isn’t all universities — students have just a few weeks to make a major life decision.

“I worry most about a student in, say, rural North Carolina that has heard all their life … they can’t afford college,” Feldman said, “and we can’t get them the document that proves they can, and we lose out on that talent.”

An Ongoing Effort

The FAFSA cycle isn’t over yet.

Keller of NCAN said there will need to be a unique push this year to continue encouraging students and families to submit their FAFSA into the summer. They may miss important deadlines, but students can submit their applications the day before classes begin and still qualify for federal financial aid like Pell Grants and student loans.

Jill Desjean, senior policy analyst at the National Association of Student Financial Aid Administrators, told BestColleges that this will still require ED to address ongoing issues.

One remaining issue, she said, is the need to reprocess 20% of FAFSAs.

ED originally was going to let some FAFSAs remain with errors if those errors would give students access to more financial aid. Desjean said that many financial aid administrators worried, however, that doing so would draw ire from accrediting agencies and other oversight groups who would question why schools were improperly awarding taxpayer funds to students.

“We’re constantly being told by the department that we need to make sure that the right amounts of money get into the right students’ hands,” she said.

ED later reversed its stance and decided to reprocess all FAFSAs with errors.

Desjean added that it’ll be important to push students to submit their FAFSA through the summer. The reality is, however, that many graduating high school seniors will lose access to their school’s guidance counselors once they receive their diploma.

“We’re squeezing so much work into a short time frame,” she said.

Other Options Remain for Affected Students

There is one potential beneficiary of FAFSA issues, Keller said: Community colleges.

Most community colleges don’t have decision deadlines like four-year universities. That means students who miss out on the initial wave of decisions due to FAFSA hiccups can still submit their applications over the summer and enroll in a community college in the fall.

“There’s a chance that community colleges could benefit from this,” Keller said.

However, that comes with other issues.

Desjean explained that community colleges likely aren’t prepared to take in a large influx of students this fall.

Additionally, she said transferring credits isn’t always as easy as it seems. So, if students decide to enroll in a community college to transfer into a four-year university later, they should be careful to take classes that will actually be transferable.

Keller added that even if students miss enrollment deadlines, they should consider whether they can enroll in the spring semester instead. Doing so may impact how much institutional aid they qualify for, but they’ll still be eligible for federal financial aid.

Looking Ahead to 2025-26 School Year

Republican Rep. Brandon Williams of New York asked the panel of experts to rate their confidence level that ED’s 2025-26 FAFSA rollout will be “flawless” this October.

The panel’s responses:

- “Medium. We have less than six months until the Oct. 1 start date. I’m not certain that they [won’t] have to delay that start date.”

- “Low.”

- “Medium.”

- “I’d also say low. I think right now I have no confidence that we’ll have any records at the beginning of October.”

Mark Kantrowitz, a financial aid expert and president of Cerebly Inc., explained that ED is already behind schedule for the 2025-26 FAFSA.

He told lawmakers that Federal Student Aid (FSA) typically publishes a draft version of the next FAFSA in March, which would then be released to the public to complete on Oct. 1. Halfway through April, ED has yet to publish any draft of the 2025-26 form.

“They could still get it done by Oct. 1,” Kantrowitz said, “but I’ve seen no signs that they are working on it.”

This story was produced by BestColleges and reviewed and distributed by Stacker Media.