States most popular with Gen Z homebuyers

Published 3:45 pm Thursday, September 19, 2024

States most popular with Gen Z homebuyers

In today’s housing market, many young adults have lost hope that they will ever attain homeownership.

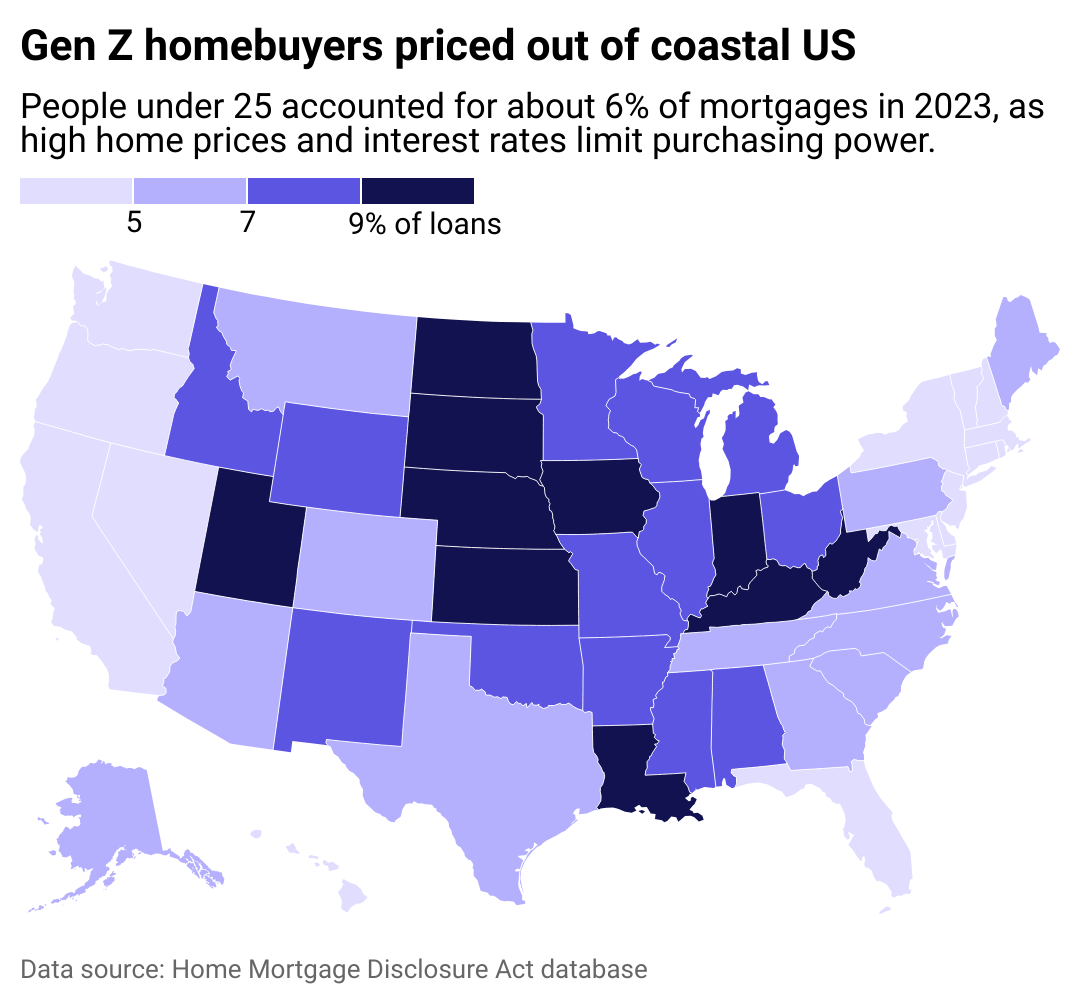

Low inventory, high interest rates, and record-high prices keep many prospective first-time buyers on the sidelines. Indeed, few members of Gen Z—those born between the late ’90s and 2012—have achieved homeownership to date. Just over 1 in 4 adults in this generation were homeowners in 2023, according to Redfin. The same year, buyers under 25 made up 6% of all loan purchases, despite comprising 12% of the U.S. adult population, the latest government data shows.

Even so, Gen Z homebuyers have slightly higher success rates than earlier generations did at their age, particularly in certain markets. Spokeo analyzed data from the Home Mortgage Disclosure Act database to determine the states most popular among Gen Z homebuyers in 2023, based on the concentration of mortgages taken out by buyers under age 25.

Affordability is key. Younger buyers typically purchasing their first homes don’t have significant savings, inheritance, or proceeds from a previous home sale to compete with older adults. This is also shown in their loan values: Buyers under 25 received less than 4% of actual mortgage dollars approved in 2023.

With a lack of traditional starter homes and sky-high prices on the coasts, the Midwest has become an unexpected hotspot for young Americans prioritizing homeownership.

![]()

Spokeo

Gen Z buyers are more prevalent in less expensive regions

Home prices in the U.S. continue to hit all-time highs, reaching a median of $462,900 in June. The Midwest offers the lowest-cost homes in the country, with a median sales price of $327,100—a whopping $125,000 below the national average.

It’s no wonder, then, that younger—typically less wealthy—buyers are finding greater success in the nation’s least expensive region. Midwestern states generally saw higher shares of Gen Z mortgage approvals, with Iowa and Indiana making the top five alongside West Virginia and the Dakotas.

Between the rise of remote work and more balanced regional economies, young Americans are less restricted in where they can live, launch their careers, and build wealth. In turn, hopeful Gen Z buyers can consider going for less expensive homes further from traditional job centers in major metropolitan areas.

In Iowa, the top state for buyers under 25, the median sale price of a home was about $248,000 in June, and young buyers claimed 12% of loan 2023 purchases. Within the state, Waterloo and Dubuque are among the most popular metros for Gen Zers, according to Realtor.com. Both are mid-sized cities nestled along riverfronts, offering residents access to plentiful jobs, outdoor recreation, natural scenery, and quick access to restaurants, shops, and entertainment. Though increased popularity is beginning to drive prices up in Midwest cities, the region remains the most affordable in the nation.

High prices in Midwestern cities and other states in the Northeast and on the West Coast are keeping young buyers out of those markets. Gen Z had the least luck in Massachusetts, where the median home cost is $668,000, and buyers under 25 received less than 3% of mortgage loans in 2023.

Despite cost hurdles, Gen Z members are achieving higher homeownership rates than millennials and Gen X did at their age. Gen Z’s emerging adults were offered record-low interest rates after the COVID-19 pandemic, and many jumped to purchase homes with more affordable payment terms. Millennials, meanwhile, entered the housing market in the wake of the 2008 crash, while Gen X faced record-high mortgage rates in their early adulthood.

Now that interest rates have risen again and prices remain high, Gen Z buyers just becoming adults or entering the market now have lost that advantage. Still, between first-time homebuyer loans and assistance programs, student loan forgiveness, flexible working arrangements, and more accessible market research capabilities, Gen Z’s young adults have tools at their disposal that could help them become more prolific buyers than their predecessors.

Story editing by Mia Nakaji Monnier. Additional editing by Kelly Glass. Copy editing by Paris Close. Photo selection by Lacy Kerrick.

This story originally appeared on Spokeo and was produced and

distributed in partnership with Stacker Studio.