Average mortgage balances exceed $1 million in 47 cities in 2024

Published 2:30 pm Monday, October 7, 2024

Average mortgage balances exceed $1 million in 47 cities in 2024

With mortgage rates hovering around 7% for much of the past year and home prices stubbornly remaining high, more borrowers are taking on mortgages in excess of $1 million. Compared to last year, the number of cities where average mortgage balances exceed $1 million has mushroomed, from 26 cities in 2023 to 47 cities in June 2024. (The analysis only includes cities where at least 200 mortgages were reported to Experian.)

This is the case despite home sales—and the new mortgages written for those purchases—that are still below pandemic-era levels. Of those home sales, only about two-thirds required some sort of mortgage financing, as 32% of home sales were all-cash transactions in the first part of 2024, according to the National Association of Realtors. That’s a decade high, even with median existing home sale prices increasing to a record $426,900 in June 2024.

In this analysis, Experian takes a look at which cities are paying the most for their mortgages, what they might have in common, and what might be next for the mortgage market.

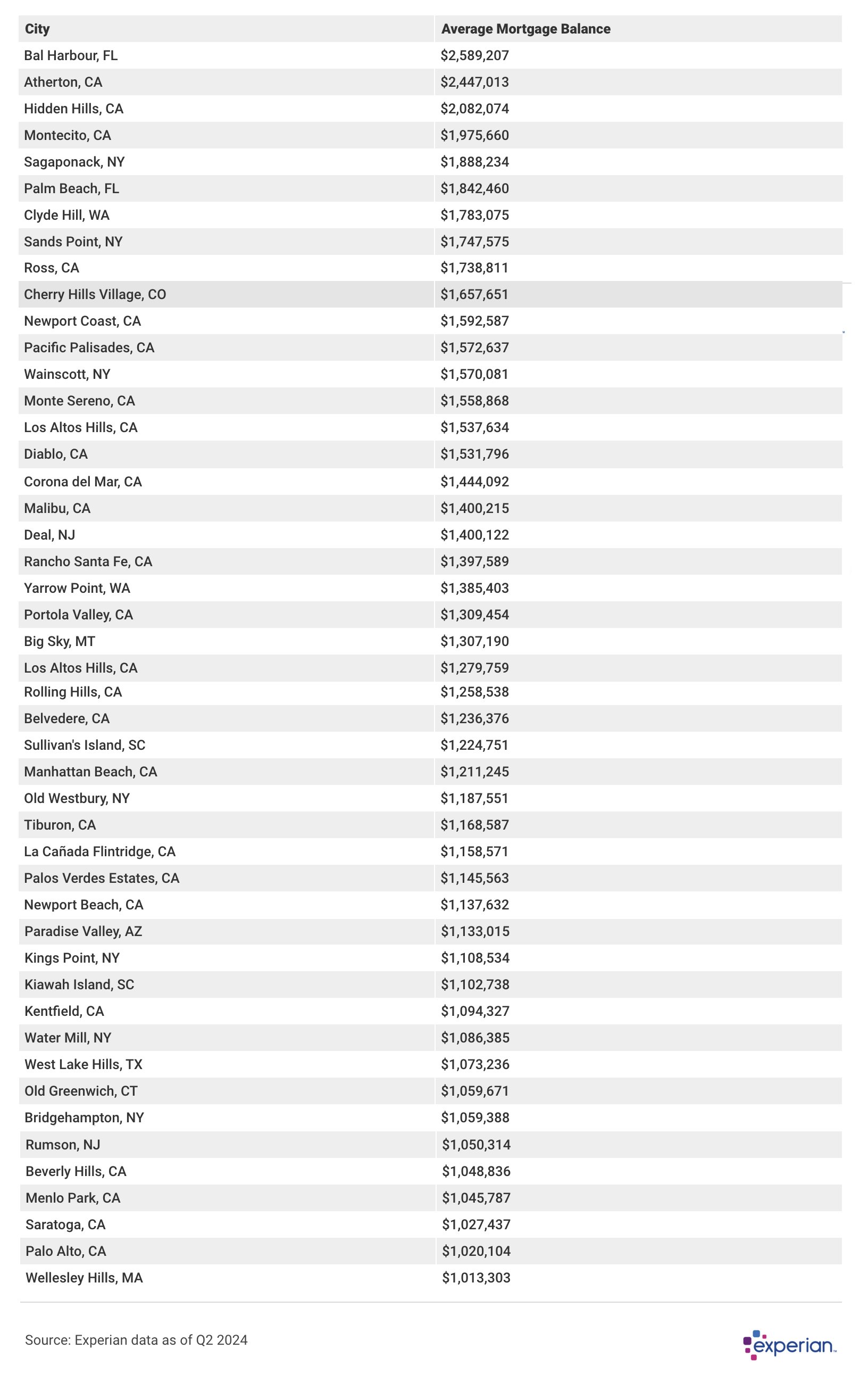

47 Million-Dollar-Mortgage Cities (and a Few $2 Million Cities)

While California cities and towns dominated this list of hefty-sized mortgages in 2023, the heavyweight cities are spread somewhat more broadly this year. New states where million-dollar-mortgage cities appeared in 2024 are Colorado, Connecticut, Massachusetts and Texas.

Notable debutantes in 2024 include several Northeastern cities like Wellesley Hills, Massachusetts, and Old Greenwich, Connecticut (where new mortgages may mean the money there isn’t as old as the name suggests). The Hamptons on Long Island, New York, had four $1 million-plus-mortgage communities in 2024. Nonetheless, the suburbs and exurbs of San Francisco and Los Angeles still account for the majority of communities where million-dollar mortgages are common.

Nonetheless, the suburbs and exurbs of San Francisco and Los Angeles still account for the majority of communities where million-dollar mortgages are common.

As noted below, there are even three cities where the average mortgage balance exceeds $2 million. Bal Harbour, Florida; Altherton, California; and Hidden Hills, California, all have average mortgage balances exceeding $2 million as of June 2024, according to Experian data.

![]()

Experian

Mortgage Balances Nationwide: The State of Play

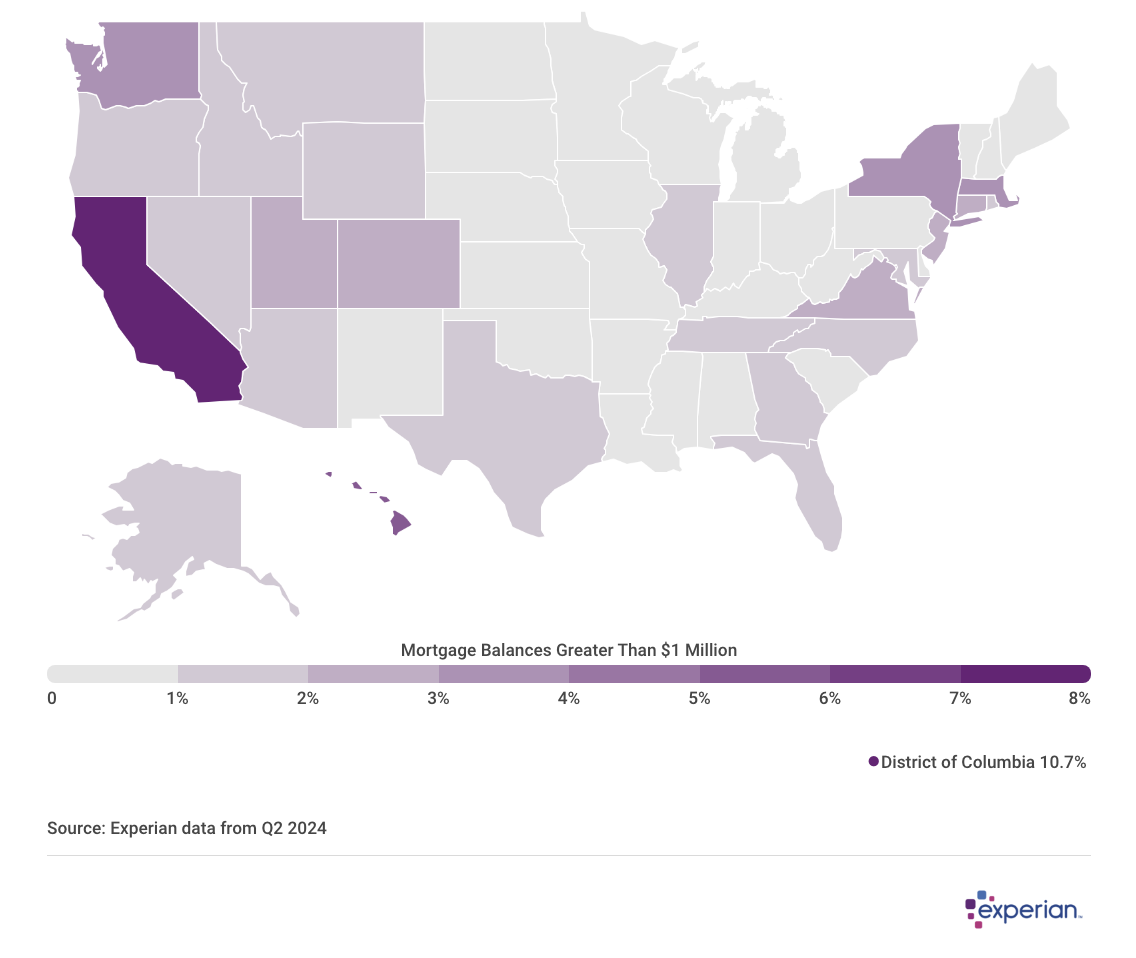

There’s no state, of course, where the average mortgage balance is anywhere near $1 million. The closest is California, with a June 2024 average mortgage balance of $443,000. California also leads the pack in terms of the percentage of mortgages that have a balance of $1 million or more, with 7.4% of the state’s mortgages averaging $1 million-plus.

Notably, Washington, D.C., has an average balance of $506,600. In fact, more than 1 in 10 mortgages reach the million-dollar mark in the nation’s capital.

Nonetheless, while million-dollar mortgages aren’t the norm anywhere, they’re not exactly unusual anymore either, not only in picturesque seaside towns and cities, but also throughout the country.

Experian

High-Dollar Mortgages: Credit Still Plays a Role

Although credit scores are always a consideration when applying for a mortgage, it’s perhaps even more so for a portion of the new $1 million mortgages being made in 2024.

Depending on their location, these properties may require non-conforming mortgages, typically in the form of a jumbo loan, as the limit on the size of conforming mortgages is still somewhat less than $1 million: $766,550 in 2024, up from $726,000 in 2023. (However, among some chronically expensive parts of the nation, including counties in California and New York where many of these million-dollar mortgage cities appear, the conforming-mortgage limit can be as high as $1.15 million.)

When mortgages of this size necessitate non-conforming loans, lenders pay extra scrutiny by requiring higher credit scores, lower debt-to-income ratios and higher down payment amounts. That’s because the bank may have to keep the loans on their balance sheet, which increases their risk should the loan fail. While mortgages small enough to be sold to Freddie Mac and Fannie Mae are guaranteed, jumbo loans are not.

Currently, average jumbo loan APRs are roughly a quarter-percentage point higher than conforming mortgages’ rates. Improving credit might be key for some buyers hoping to land a whale of a mortgage at an interest rate that won’t sink them.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO® Score 8 version. Different sampling parameters may generate different findings compared with other similar analyses. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.