Election 2024: Comparing the presidential candidates' tax policy stances

Published 1:00 pm Thursday, October 17, 2024

Election 2024: Comparing the presidential candidates’ tax policy stances

As the U.S. presidential election approaches, tax policy is a critical topic for voters. The candidates’ tax plans not only reveal their broader economic ideologies but also provide insight into how they will manage issues like income inequality, economic growth, and fiscal responsibility. To help you understand where each candidate stands, Wealth Enhancement compares the tax policy plans proposed by Vice President Kamala Harris (D) and former President Donald Trump (R).

Overview of the Candidates’ Tax Plans

At a high level, Kamala Harris supports a more progressive tax system aimed at increasing taxes on high-income individuals and large corporations while providing relief to middle- and lower-income families. Her goal is to use tax revenues to fund social programs, close the wealth gap, and invest in public services.

Donald Trump, on the other hand, remains a proponent of supply-side tax policies that prioritize tax cuts for businesses and high-income individuals, with the aim of spurring economic growth, job creation, and investment. His plan is a continuation of the tax reforms he implemented during his 2017 presidency.

Trending

![]()

Wealth Enhancement

Comparing the Candidates’ Tax Plans

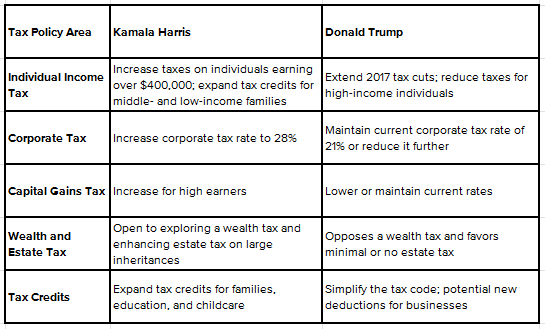

To assess each candidate’s tax plan, it can be helpful to compare their stances around specific tax policy areas, as presented in the table above.

To understand the reasoning behind these divergent approaches, consider these proposals at a more granular level.

Individual income tax

- Harris proposes raising taxes on high-income individuals, particularly those earning more than $400,000 per year. She has also advocated for expanding tax credits, such as the Child Tax Credit and Earned Income Tax Credit, to provide relief for middle- and lower-income families. Her aim is to reduce income inequality by shifting more of the tax burden onto the wealthiest Americans.

- Trump plans to extend the tax cuts introduced by his administration in 2017. He intends to lower taxes for all income levels, but is especially focused on high earners. He also proposes exempting Social Security benefits from taxation. He argues that lowering income taxes will encourage productivity and increase disposable income, leading to economic growth.

Corporate tax

- Harris favors increasing the corporate tax rate from the current 21% to 28%. She argues that large corporations, especially those with record profits, should contribute more to the country’s economy. She plans to use the additional revenue to fund public infrastructure, education, health care, and green energy investments.

- Trump aims to maintain or further reduce the corporate tax rate of 21%, a significant reduction from the 35% rate that was in place before his 2017 tax reform. He believes that keeping corporate taxes low will encourage companies to invest domestically, creating more jobs. He views high corporate taxes as detrimental to American competitiveness in the global economy.

Capital gains tax

- Harris supports raising the long-term capital gains rate to 28% for those earning over $1 million annually. She argues capital gains should be taxed at the same rate as ordinary income to address a loophole that allows wealthy investors to pay lower tax rates than wage earners.

- Trump seeks to lower the capital gains tax or keep it at current levels to spur investment in businesses and real estate. He believes that reducing the tax burden on investors will lead to more dynamic financial markets, while driving job creation and economic growth.

Trending

Estate and wealth taxes

- Harris is open to exploring a wealth tax on the ultra-rich. She also supports strengthening the estate tax by taxing large inheritances more heavily. This is part of her broader goal to reduce wealth inequality by making sure the richest Americans contribute more to the nation’s tax base.

- Trump opposes any form of wealth tax and supports maintaining a low estate tax or eliminating it entirely. He believes taxing inheritances may discourage wealth accumulation and investment in future generations. His tax policy aims to minimize the tax burden on family-owned businesses and large estates.

Tax credits and deductions

- Harris plans to expand tax credits for working families. This includes making the Child Tax Credit permanent and increasing the Earned Income Tax Credit. She also supports new deductions related to education, health care, and housing, along with tax credits to promote investments in renewable energy, electric vehicles, and energy-efficient home improvements. Some specific proposals include a first-time homebuyer credit or $25,000 to apply towards a down payment, as well as increasing the tax deduction for small businesses from $5,000 to $50,000.

- Trump has indicated that he would consider new deductions for businesses and individuals, especially in areas such as health care and childcare. He is also interested in simplifying the tax code to make it easier for Americans to file their taxes.

Making Informed Decisions

Candidates Kamala Harris and Donald Trump offer voters two distinct visions of how taxes should be structured in America. To explore how these differential tax policies might impact your financial plan, reach out to your financial advisor.

This story was produced by Wealth Enhancement and reviewed and distributed by Stacker Media.