What Trump's second term as U.S. president might mean for financial markets

Published 4:30 pm Friday, October 25, 2024

What Trump’s second term as U.S. president might mean for financial markets

A look back at President Trump’s relationships with NATO, Russia, Ukraine, and the trade war with China. OANDA shares how these relationships affected the financial markets and what to expect from Trump in a second term.

Donald Trump as Republican Nominee for U.S. President

Donald Trump served as president of the United States from 2016–2020 and lost the 2020 election to Joe Biden. Midway through the 2024 presidential campaign, Trump has locked up the Republican nomination for president after easily beating the other Republican candidates.

This article will discuss the possible ramifications that a second Trump presidency could have on the global financial markets.

Trump’s ‘America First’ Doctrine

Relationship with NATO

The North Atlantic Treaty Organization, or NATO, is made up of 31 member countries and essentially serves as a military umbrella that has protected Europe since World War II.

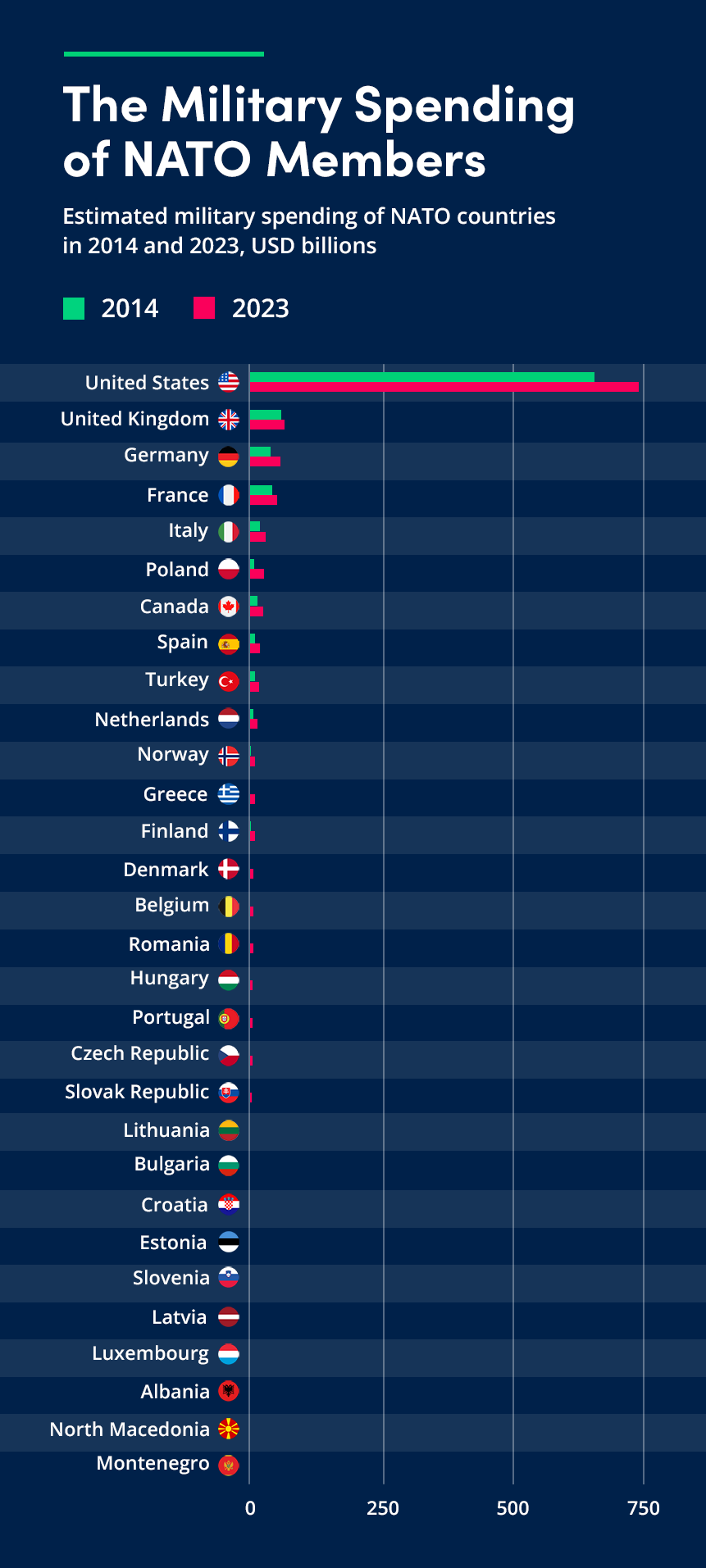

The United States pays for about 22% of NATO’s budget, and the issue of “sharing the burden fairly” amongst NATO members has been around for many years. In 2014, NATO members agreed to set a target of spending 2% of their GDP on military budgets. At that time, only three members met the target, including the United States. The alliance’s defense spending has surged since then, and the head of NATO announced in February 2024 that 18 members were expected to hit the 2% target.

As president, Donald Trump frequently complained that European NATO members were not paying their fair share of funding for NATO and publicly called on them to raise their defense spending. These comments, which were often extreme, typically were followed by volatility in global financial markets, particularly in European equity markets and the currency markets. Investors were understandably concerned about the health of the NATO alliance, which has been a cornerstone of global security since World War II. The specter of a U.S. president publicly attacking other NATO members risked geopolitical stability and hurt investor confidence.

On the 2024 presidential campaign trail, Trump has continued to rebuke NATO members for not paying their fair share of defense spending. There have been reports that when Trump was president, he considered leaving NATO over this issue.

This has understandably led to alarm in European capitals as well as in the Biden administration, with the latter attacking Trump’s stance as irresponsible and dangerous. At the same time, Trump supporters would argue that Trump’s threats against the Europeans are the reason that more NATO members have reached the 2% target in defense spending, and in doing so, Trump has actually strengthened the alliance.

Note: Iceland has no armed forces.

![]()

OANDA, NATO

Trump’s Potential Re-Election Could Stir Market Volatility Amid NATO Tensions

If Trump is re-elected president, he can be expected to continue his hard-line stance with NATO members. This may be followed by volatility in the equity and currency markets. Extreme statements from Trump about NATO may lead to increased uncertainty over the U.S. membership in NATO which could have ramifications for global financial markets.

Supporters of Trump would argue that his bark is worse than his bite and not every provocative statement becomes policy, but the financial markets have been sensitive to threats from Trump against European allies.

Note: Iceland has no armed forces. Estimate as of mid-year.

OANDA, NATO

Trade War With China

The Trump presidency was characterized by an aggressive trade policy toward any country that the United States considered involved in unfair trade practices. This resulted in trade wars between the U.S. and much of the world, including China, the European Union, Canada, India, and others.

The most significant Trump trade war was with China, the second-largest economy in the world after the United States. As president, Trump imposed a staggering $250 billion in tariffs on a wide range of Chinese imported products. China retaliated with tariffs on American goods, leading to a full-blown trade war which lasted through much of Trump’s presidency and disrupted global trade. The U.S. tariffs made Chinese imports more expensive, put a dent in the profit of many U.S. businesses, and raised prices for U.S. consumers.

The financial markets experienced increased volatility during trade negotiations. Equity markets suffered sell-offs when tensions were high, while progress in trade talks correlated with boosted share prices.

Certain industries were strongly affected by the U.S.-China trade war and showed significant volatility. These included technology, manufacturing, agriculture, and retail and consumer goods.

- Technology: The U.S. technology sector relies heavily on global supply chains and is significantly exposed to China. Electronics and semiconductors companies, for instance, saw share prices fluctuate following tariffs and trade talk developments.

- Manufacturing: The U.S. manufacturing sector is highly dependent on Chinese imports, such as automotive manufacturers. These companies were hurt by increased costs due to higher tariffs on imported Chinese products and often were negatively affected by disruptions to supply chains.

- Agriculture: China imposed retaliatory tariffs on U.S. agricultural products, which led to reduced demand from China and resulted in price declines for soybeans, pork, and grains.

- Retail and consumer goods: The imposition of higher tariffs on Chinese imports meant that American businesses and consumers faced higher costs. The tariffs cut into company profits and dampened U.S. consumer spending, a key driver of the U.S. economy. This had a negative effect on economic activity and dampened investor sentiment.

The U.S.-China trade war had a negative effect on global supply chains, and share prices of companies dependent on these supply chains were sensitive to the ups and downs of the trade war.

Currency markets also showed fluctuations in exchange rates as a result of the trade war. During tense periods, the U.S. dollar strengthened due to a decline in risk appetite, while a reduction in trade tensions often improved investor confidence, sending the U.S. dollar lower.

Would Trump 2.0 Lead to an Escalation in Trade Wars?

What can be expected under a Trump presidency 2.0? Likely, there will be more of the same aggressive behavior against China. In January, during the current presidential campaign, Trump said he was considering imposing a blanket tariff on all Chinese imports of 60% or more. China might retaliate against the U.S. in response to any punitive measures, a scenario that could disrupt global trade and could trigger volatility in the financial markets, reminiscent of the events during Trump’s presidency.

Trump has floated the idea of revoking China’s most-favored-nation trading status. This would result in federal tariffs of over 40% on Chinese products. If China retaliates in kind, this could lead to another trade war than during Trump’s first term.

Let’s not forget that Trump initiated trade spats with allies, including Canada, the European Union, and Japan. As president, Trump could impose punitive trade measures against these trading partners if they are engaged in what he believes are unfair trade practices.

At a political rally in February, Trump declared he would pass the “Trump Reciprocal Trade Act,” saying if China or any country imposes a 100% or 200% tariff, he would impose a retaliatory tariff against that country in the same amount. Trump would likely encounter stiff opposition in Congress to a massive escalation in tariffs, but these types of extreme statements may make investors uneasy over the strong possibility that Donald Trump could once again become president of the United States.

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results. Opinions are the author’s; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

This story was produced by OANDA and reviewed and distributed by Stacker Media.