The ultimate guide to managing your money

Published 7:50 pm Monday, November 18, 2024

The ultimate guide to managing your money

Effective money management involves a range of practices and habits that help you optimize your income, reduce debt, and build financial stability. These practices may include creating a budget, tracking your expenses, saving money, paying off debts, and investing in your future.

Overall, it requires discipline, patience, and a willingness to make changes to your spending habits and money goals. But with the right strategies in place, it can help you achieve long-term financial solvency and security. Read on for Prosper‘s guide to managing your money effectively.

Set and keep track of financial goals

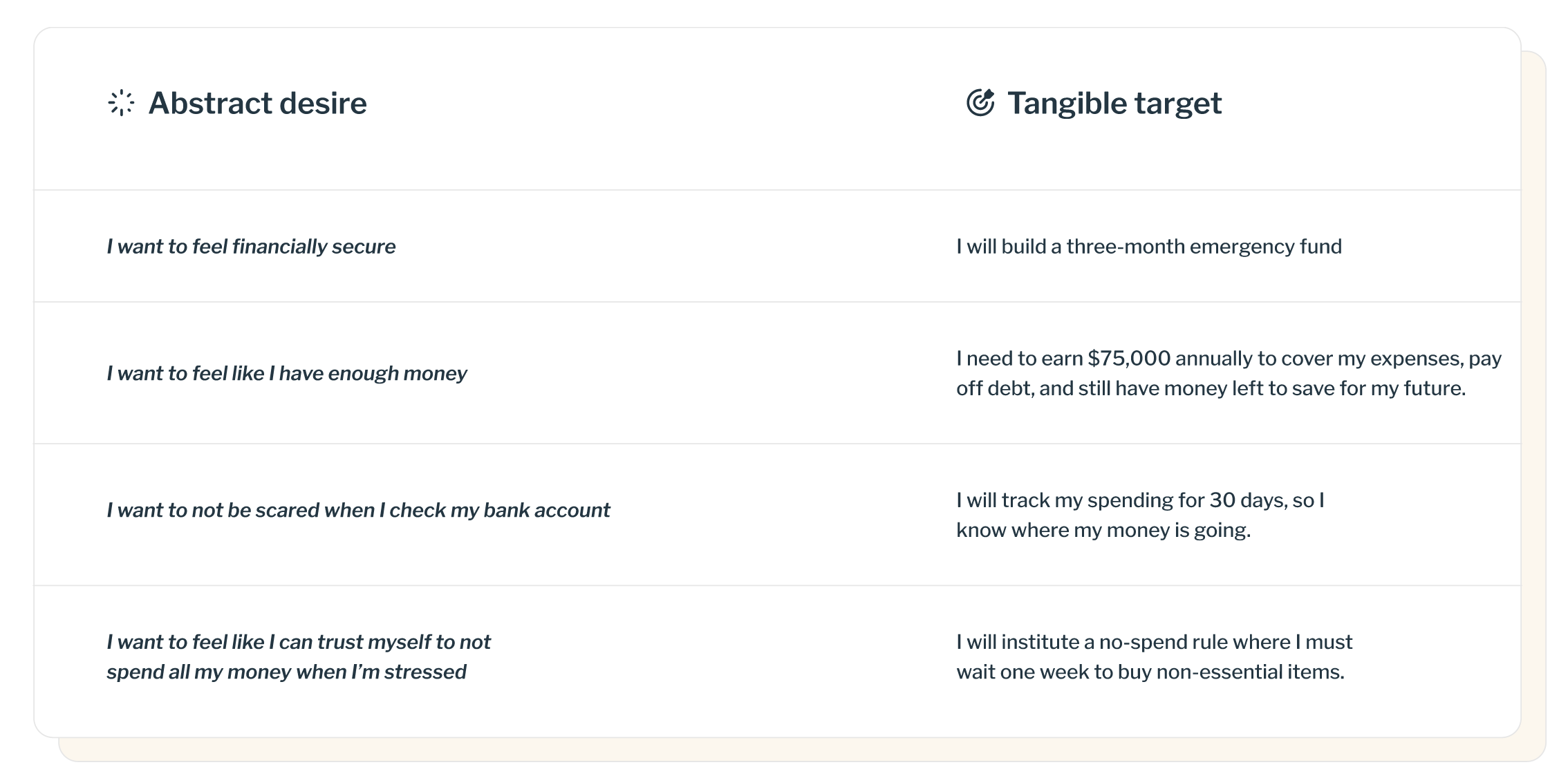

Financial goals serve as the foundation for your financial plan. They transform abstract desires into tangible targets. For instance, maybe your abstract desire is to feel more financially secure. But what does ‘financially secure’ look like for you? What needs to happen for that desire to be met?

Many people have the same abstract desires—to feel financially secure and confident. But the tangible targets you set to get there will be uniquely yours. Below are some examples:

![]()

Prosper

How to set financial goals

- Start with reflection: Consider what you value most in life and how your finances can support those values. Your goals should resonate with your personal priorities—whether that’s buying a home, traveling, having a baby, taking a gap year, or saving for retirement.

- Set short-term, midterm and long-term goals: Short-term and midterm goals are achievable within a year or two, like saving for a vacation or paying off a credit card. Long-term goals may take several years or decades, such as saving for retirement or paying off a mortgage.

- Be specific and measurable: Vague goals are hard to achieve. Instead of saying “save more money,” specify “save $10,000 in two years, so I have a three-month emergency fund.” This clarity makes it easier to plan and track progress.

- Create a savings strategy: Determine how much you need to save regularly to meet your goals. Automate your savings and investments to stay consistent.

Create a budget that works for you

A budget helps you track your earnings, spending, and savings. It isn’t about cutting out lattes and never allowing yourself to have fun; budgeting is about gaining a clear understanding of where your money is going so you can make intentional decisions with your finances.

- Start with your income: Know the exact amount you bring home each month. This includes your salary after taxes, any side hustles, and passive income streams.

- List your expenses: Begin with fixed expenses (rent, mortgage, insurance, car payments) and then estimate variable costs (groceries, gas, entertainment). Don’t forget annual or semi-annual expenses, like property taxes or insurance premiums.

- Prioritize your goals: After you estimate expenses, decide what’s next in line for the money you have left over. This could be paying down debt, building an emergency fund, or saving for retirement.

- Incorporate fun money: If you’ve struggled with budgeting in the past, it may be because your budget was too restrictive. Be sure to include a category for personal spending—yes, even that occasional latte.

- Review regularly: No two months will ever be the same, so review your spending at least weekly and move money around as needed. If you find you’re consistently overspending in one category, adjust your target amount. Perhaps you underestimated your grocery budget or didn’t account for seasonal utility bill fluctuations.

What’s your budgeting flavor?

Saying budgeting doesn’t work for you is like saying ice cream isn’t delicious. You may not like all ice cream, but there’s bound to be a flavor that delights your taste buds. The same goes for budgeting. If the first one you try doesn’t work, keep sampling until you find one that clicks.

- 50/30/20: With this method, 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayments. You can adjust these percentages to match your goals.

- Zero-based budgeting method: This method requires you to assign every dollar of your income to a job—whether it’s for expenses, savings, investments, or debt payments. The goal is to make sure your income minus your expenses equals zero.

- Reverse budgeting: This is where you put your money into savings first, then use whatever is left over for expenses and fun things.

Tips for tracking expenses

Tip #1: Start simple

If traditional budgeting hasn’t worked for you, start with a simple approach. Track your spending for 30 days by categorizing expenses as ‘needs’ (rent, groceries, utilities) and ‘wants’ (dining out, entertainment). Use a basic spreadsheet or a notebook to do this—but don’t cut out anything or make changes. Simply get in the habit of looking at your spending without judging.

Tip #2: use the right tools

Budgeting apps can simplify the process of tracking your expenses. They can connect to your bank accounts, categorize your spending, and provide insights into your financial habits.

How to deal with financial shame

If the thought of looking at your spending makes you want to run and hide, you’re not alone. Money is a taboo topic, which can intensify any shame you feel around it. “We face judgments about money from many angles: personal, professional, religious, and cultural,” says Eric Croak, certified financial planner, accredited wealth management advisor, and the president of Croak Capital, a wealth management firm in Toledo, Ohio. “As a result, admitting to others that we’re facing financial troubles is incredibly hard.”

One way to break free from this shame is to practice being kind to yourself for your past financial mistakes. “I’ve seen many clients who think that empathy and compassion mean letting themselves off the hook for their errors. But that’s not the case,” says Croak. “Recognizing a mistake, accepting responsibility for it, and not harshly criticizing yourself is a mature way to deal with errors.”

Save money and start an emergency fund

An emergency fund isn’t just a financial buffer—it’s peace of mind in its purest form. Knowing you have funds set aside for the unknown can greatly reduce your stress and anxiety.

Whether it’s job loss, medical emergencies, or sudden car repairs, an emergency fund ensures you can cover these without resorting to high-interest debt.

Beyond immediate financial relief, an emergency fund can also provide the financial independence needed to make big life decisions—like leaving a toxic job, escaping an abusive relationship, or even funding your dream business.

How to build and maintain an emergency fund

- Start small: Most experts recommend building an emergency fund that covers three to six months’ worth of expenses, but this can be unattainable if you’re just starting. It’s okay to begin with a modest goal—like saving $500 or $1,000. From there, bump it up to one month of living expenses, then two, until you get to the recommended three to six months’ worth.

- Keep it separate: Store your emergency fund in a separate high-yield savings account where you can earn interest. Separating it from your checking account will also help you avoid the temptation of spending it.

- Replenish it when you use it: If you dip into your emergency fund, prioritize topping it back up. Adjust the total amount if your monthly living expenses change.

PSA: Don’t feel bad for using your emergency fund!

Once you build your emergency fund and it’s sitting at a good number, you may feel guilty for using it. However, your emergency fund is not a trophy to admire but never touch. It’s a fire extinguisher for you to use when your financial house is on fire. As long as you’re using it on actual emergencies, it’s doing its job. Don’t feel guilty.

Strategies for saving money

- Focus on your largest expenses: For most people, housing, food, and transportation consume the lion’s share of their budget. Reducing these even slightly can have a big impact on your finances. Consider refinancing your mortgage, downsizing, or relocating to a less expensive area to cut housing costs. Plan meals and cook at home more to save on food. Use public transportation, carpool, or sell a vehicle to slash transportation costs.

- Reduce recurring expenses: Regularly audit your subscriptions and recurring bills. Cancel services you no longer use or need, and don’t hesitate to negotiate better rates on utilities, insurance, and other services.

- Use windfalls wisely: Put a portion of any unexpected cash—like tax refunds or bonuses—directly into your savings.

- Save on shopping: Consider using coupons, shopping sales, and buying secondhand goods when possible. The savings can add up quickly.

- Take it one category at a time: Rather than broadly aiming to “spend less,” identify a specific area where you’ll try to save. For example, one month, you might focus on lowering food costs, so you might try a less expensive grocery store for 30 days as an experiment. The next month, you might choose a new category.

- Automate your savings: Set up automatic transfers from your checking account to a savings account so money gets moved the moment you get paid. This “set it and forget it” method ensures you save regularly without having to think about it. You can also look into a debit card that rounds up your spare change.

Manage and pay off your debt

The average American household has $101,915 in debt, including a mortgage, based on recent data from Debt.org. This debt can lead to all sorts of mental health problems. A Forbes Advisor debt study found that 48% of people with debt report having difficulty sleeping, 40% have increased anxiety levels, 38% have a reduced social life and 34% indicate having depression.

There are many reasons why people find themselves in debt—high inflation, job loss, medical emergencies and chronic illnesses, poverty, divorce, relocations, overspending, or a lack of financial literacy. Some of these reasons are in your control, but many of them aren’t.

Tips to pay off debt

- Assess your debt: Start by laying out all your debts. Create a spreadsheet listing each debt’s balance, interest rate, and minimum payment. This will give you a clear picture of what you’re facing and help prioritize which debts to tackle first.

- Choose a repayment strategy: Two popular methods for prioritizing debt are the debt snowball and the debt avalanche. The snowball method involves paying off the smallest debts first to gain momentum, while the avalanche method focuses on paying off debts with the highest interest rates first to save the most money over time.

- Set clear priorities: If you have multiple financial goals, establish an order of operations. For example, while maintaining minimum payments on all debts, you might prioritize building a starter emergency fund before aggressively paying down debt; that way you avoid adding more debt to your plate if a problem pops up.

Debt consolidation options

A debt consolidation loan is where you combine multiple debts into a single, larger loan. It’s worth considering if you have good credit and will qualify for lower interest rates, a lower monthly payment—or both. You can consolidate debt in a few different ways:

- Balance transfer credit cards: If you have credit card debt, consider transferring balances to a card with a 0% introductory APR offer. You usually get 12 to 24 months to pay off the balance without accruing extra interest. There’s often a balance transfer fee (usually a percentage of the transferred amount), so factor that into your costs.

- Personal loans: A personal loan is an unsecured loan from a bank, credit union, or online lender that you can use for any purpose, including consolidating debt. When used for debt consolidation, you take out a loan for the amount needed to pay off your existing debts, and then you use the funds from the loan to pay them off. You’re left with one monthly payment for the personal loan.

- Home equity loans: If you’re a homeowner, you can borrow against the equity built up in your home and use it to pay off debts. Home equity loans typically have lower interest rates than credit cards or personal loans because they’re secured by your home. But you could lose your home if you fail to make the payments.

Develop good credit habits

Your credit score is a three-digit number ranging from 300 to 850. It acts as a summary of your creditworthiness, and lenders use it to assess the risk of lending you money.

You technically have multiple credit scores. The two most well-known models are FICO and VantageScore. These scores are calculated using information from your credit reports—like your payment history, amounts owed, length of credit history, credit mix, and new credit inquiries.

A higher credit score can lead to better loan terms and lower interest rates. It can even influence your ability to rent an apartment or get a job.

Build and maintain good credit

- Pay on time: Your payment history is the single most significant factor in your credit score. Pay your bills on time, always.

- Keep balances low: Keeping high balances on your credit cards and lines of credit can hurt your credit score. The sweet spot is to keep your credit utilization ratio below 30%.

- Hold onto old accounts: The length of your credit history matters. Keep older accounts open—even if you’re not using them—to maintain a longer average credit history.

- Limit new credit inquiries: Every time you apply for credit, it can cause a small, temporary dip in your score. Apply for new credit sparingly.

- Diversify your accounts: Having a mix of different types of credit accounts—including revolving credit and installment loans—can benefit your score.

Invest in your financial future

If you want to build the kind of wealth that allows you to live a comfortable retirement, leave a legacy for your family, or donate to charities you care about, it starts with investing.

It may feel safer to keep all your money in a savings account, but these earn lower interest rates than the rate of inflation. So over time, the purchasing power of your money diminishes even though your balance is growing.

That’s why investing in your future is so important. It allows your money to work harder for you by potentially earning higher returns. Although investing carries risk—including market volatility and the potential for loss—historically, the stock market has had an average 10% return over the past 30 years. Meanwhile, the current average savings account rate is 0.46%.

The power of starting young

“People will be amazed at the effect that compounding can have on their investments,” says Chris Urban, certified financial planner and founder of Discovery Wealth Planning. “Even if you invest what may feel like a small amount of money in your 20’s, by the time you reach your 50’s, 60’s, 70’s, the simple power of compound interest could turn these amounts into very sizable account balances.”

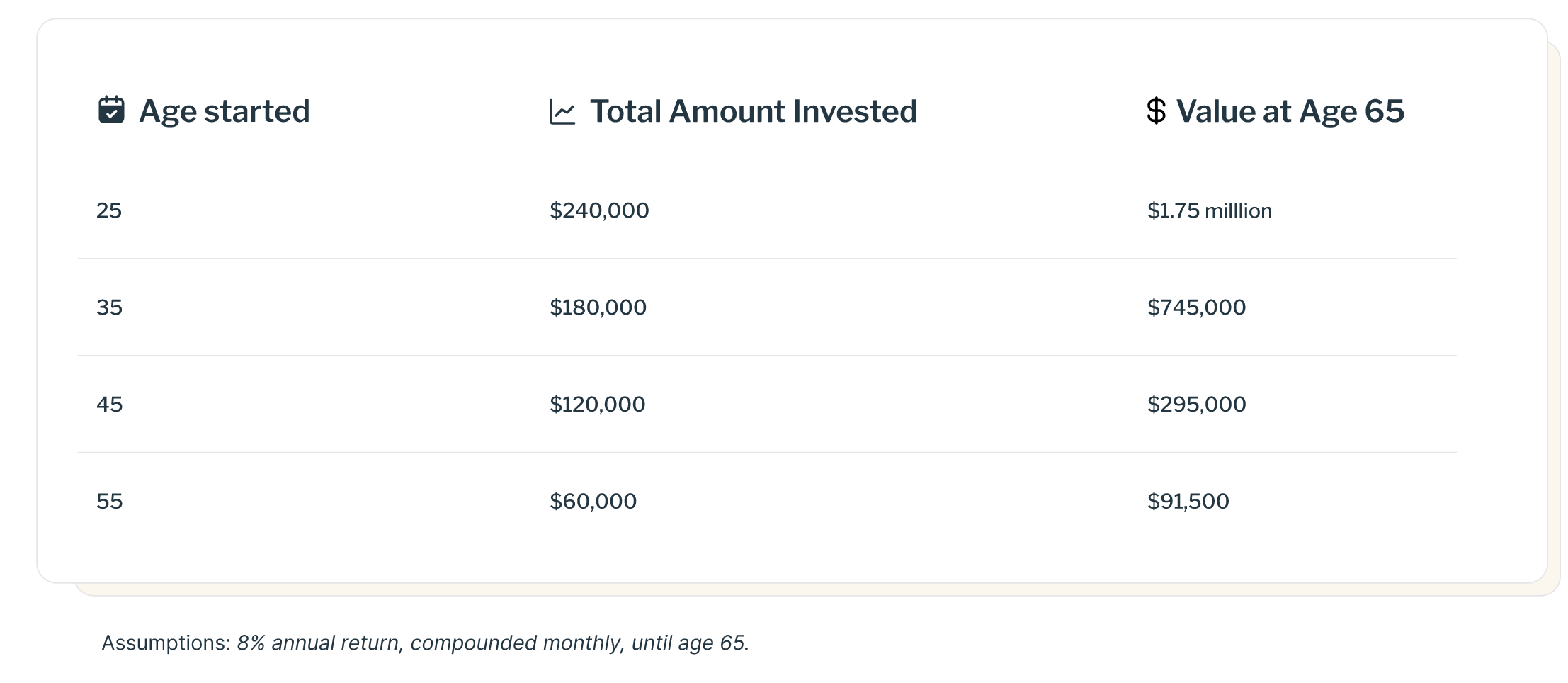

For example, say four individuals decide to start investing $500 a month until they reach age 65. They do everything the same way; the only difference is the age at which they start.

The table below shows that the earlier you start, the more you benefit from compounding. Imagine retiring at age 65 with $1.75 million even though you invested only $240,000—all because you started at age 25. That’s powerful.

At the same time, don’t get discouraged if you see this chart and think, “Oh shoot. I’m in my 50s. I’ve missed my mark. I didn’t start early enough.” Even at age 55, this person generated an extra $41,000 in returns. Because they chose to start anyway, they’ll enter retirement with nearly $100,000 more than they had before.

Prosper

Different types of investments

When you open an investment account, you’re not just storing money as you would in a savings account; you’re using that money to buy things like stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These are all different types of investments:

- Stocks: Stocks have high growth potential, but can also be volatile because you’re putting your money into one specific company. If that company performs poorly, the value of your stock can go down.

- Bonds: When you buy a bond, you’re lending money to an entity (like the government or a corporation) for a period of time. The entity agrees to pay you back the original loan amount plus interest. Bonds are typically considered safer investments than stocks.

- Mutual funds: Mutual funds are managed by professional fund managers who decide which securities to buy or sell within the fund’s portfolio. They’re essentially diversified portfolios of stocks, bonds, or other securities. Rather than buying a bunch of stocks or bonds individually, the managers do it for you through one fund.

- Exchange-traded funds: ETFs are similar to mutual funds in that you’re buying a collection of securities. However, ETFs are traded on stock exchanges and can be bought and sold throughout the day just like individual stocks. Many ETFs are passively managed and track a specific index (like the S&P 500), commodity, or other assets.

Align investments with goals

There are many different ways to invest—but the key is to make sure your strategy aligns with your financial goals and time horizon.

- Short-term goals: For goals within the next few years—like your emergency fund or a down payment on a house—consider safer investments like high-yield savings accounts.

- Long-term goals: If you’re saving for retirement or a goal that’s at least 10 years away, consider investing the money for potentially higher returns.

Also, keep your risk tolerance in mind. Younger investors generally have a higher risk tolerance because they have more time to recover from market downturns. As you age or get closer to needing the money, you may want to shift to a more conservative portfolio to protect your investments.

Where to start if you’re new to investing

If you’re new to investing, Chris Urban, a CFP, says to keep it simple. “I wouldn’t recommend individual stocks, bonds, commodities, or alternatives. Stick with low-cost, index-based, exchange-traded funds (ETFs) and mutual funds.”

These securities allow you to invest in a broad array of securities through a single transaction. They provide instant diversification, which is harder to achieve when buying individual stocks or bonds.

Urban also says to keep an eye on the fund’s expense ratio. “In my opinion, reasonably priced funds have an expense ratio at or below 30 bps (0.30%).”

Plan for retirement

Social Security benefits are meant to replace only 40% of your average income. You’ll need additional money to cover all your expenses, so it’s important to start planning for retirement now to give your savings as much time as possible to grow.

How much money do you need to retire?

The Rule of 25 is a quick trick for estimating your target retirement number. It works like this: Take your estimated annual expenses in retirement and multiply them by 25. So, if you anticipate needing $50,000 a year, your target retirement number would be $1.25 million ($50,000 x 25).

Different types of retirement accounts

- 401(k): This employer-sponsored retirement plan allows you to save and invest a portion of your paycheck before taxes are taken out. Many employers will match your contributions up to a percentage, which is essentially free money.

- IRA (Individual Retirement Account): An IRA is a retirement account you open and fund yourself. There are two main types: Traditional IRAs provide a tax deduction for the year you contribute, and Roth IRAs offer tax-free growth and withdrawals in retirement.

- Other accounts: Depending on your employment status, you might have access to other types of retirement accounts like a 403(b) for public school and nonprofit employees, a 457 plan for government workers, or a SEP IRA or Solo 401(k) for self-employed individuals.

Strategies for maximizing retirement savings

No matter which type of retirement account you have, there are steps you can take to prepare for a comfortable retirement:

- Start early and save regularly: The earlier you start saving for retirement, the better. Even small, regular contributions can grow significantly over time due to compound interest.

- Take full advantage of your employer match: If your employer offers a 401(k) match, make sure you’re contributing enough to get the full match. It’s part of your compensation package, so not doing so is like leaving money on the table.

- Increase contributions over time: As you receive raises or pay off debts, increase the amount you’re saving for retirement. Try to max out your accounts if you can.

- Use catch-up contributions: If you’re age 50 or older, you can make additional catch-up contributions to your 401(k) and IRAs. This allows you to set aside larger amounts of money for retirement as you approach retirement age.

- Avoid early withdrawals: Withdrawing money from your retirement accounts before age 59½ can result in penalties and taxes—and it also robs your future self of potential growth. Resist the temptation to tap into these funds for non-retirement expenses.

Building wealth over time

Building wealth is how you create long-term financial security for yourself and your family. It enables you to weather economic storms and achieve your big life goals—whether that’s buying a home, starting a business, funding a child’s education, or retiring comfortably.

Rule #1: Live below your means. This means spending less than you earn and saving the rest. You don’t have to skimp on everything, but be mindful of your spending. Prioritize expenses that align with your long-term goals and cut back on those that don’t. Perform a financial audit at least once a year to monitor your progress.

Rule #2: Avoid high-interest debt. Not all debt is bad, but you should limit the amount of high-interest debt you take on, which is usually debt with an interest rate of 10% or above. This type of debt tends to eat away at your ability to save and invest because the interest rate is so high.

Rule #3: Invest wisely. Put your money into investments that have the potential to earn higher returns than a traditional savings account. Consider a diversified mix of index funds, ETFs, or mutual funds. The longer your money can sit in the stock market, the greater your odds are that it will grow.

Five tips for increasing your income

As you learn how to manage money, increasing your income can yield better results than trying to slash a ton of expenses. Try these tips:

- Negotiate your salary: Don’t be afraid to ask for a raise if you believe your work merits it. Do your research to know what someone with your skills and experience should be earning.

- Develop your skills: Investing in your education and professional development can lead to better job opportunities and higher income over time.

- Consider side hustles: Look for ways to earn extra income outside of your primary job. This could be freelance work, a part-time job, or turning a hobby into a source of income.

- Generate passive income: Truly passive income doesn’t exist because everything requires some level of work. But you could earn semi-passive income by earning royalties from writing a book, creating an online course, or owning rental properties.

- Use peer-to-peer lending: Platforms that allow you to lend money directly to individuals or small businesses can offer attractive returns, although they also come with their own set of risks.

Mastering money management

Learning how to manage your money isn’t about quick fixes or cutting out small pleasures; it’s about consistency, making smart financial decisions, and being kind to yourself along the way.

Remember, developing good money management skills requires the same patience and discipline as learning to drive a car for the first time. Give yourself grace as you begin managing money, and don’t forget to celebrate the wins as you go.

Money wins worth celebrating

Remember, every step towards managing your money effectively is a victory. Here are some money wins worth celebrating:

- Moving $20 to your savings account.

- Read a book on personal finance for beginners.

- Canceling a subscription you don’t use.

- Putting your credit card bill on auto-pay to avoid late fees.

- Cooking at home instead of eating out.

- Negotiating a bill and saving money.

This story was produced by Prosper and reviewed and distributed by Stacker.