How to find the best small business health insurance

Published 6:30 pm Wednesday, December 11, 2024

How to find the best small business health insurance

For most small businesses, offering health insurance is a way to attract and retain top talent, enhance employee satisfaction, and boost productivity. In fact, Thatch recently found that 73% of small business owners believe offering competitive benefits is important to their business’ overall success.

Balancing affordability, coverage, and compliance is no small feat when looking for the best health insurance for your small business. With complex insurance terms, varying coverage levels, and unpredictable premium hikes, identifying the best fit can feel overwhelming.

Key Takeaways:

- Offering health insurance boosts employee satisfaction and retention.

- Options range from traditional group plans to flexible HRAs like ICHRA.

- Key factors include cost, coverage, compliance, and administration.

- ICHRA plans offer small businesses flexibility, tax advantages, and cost control.

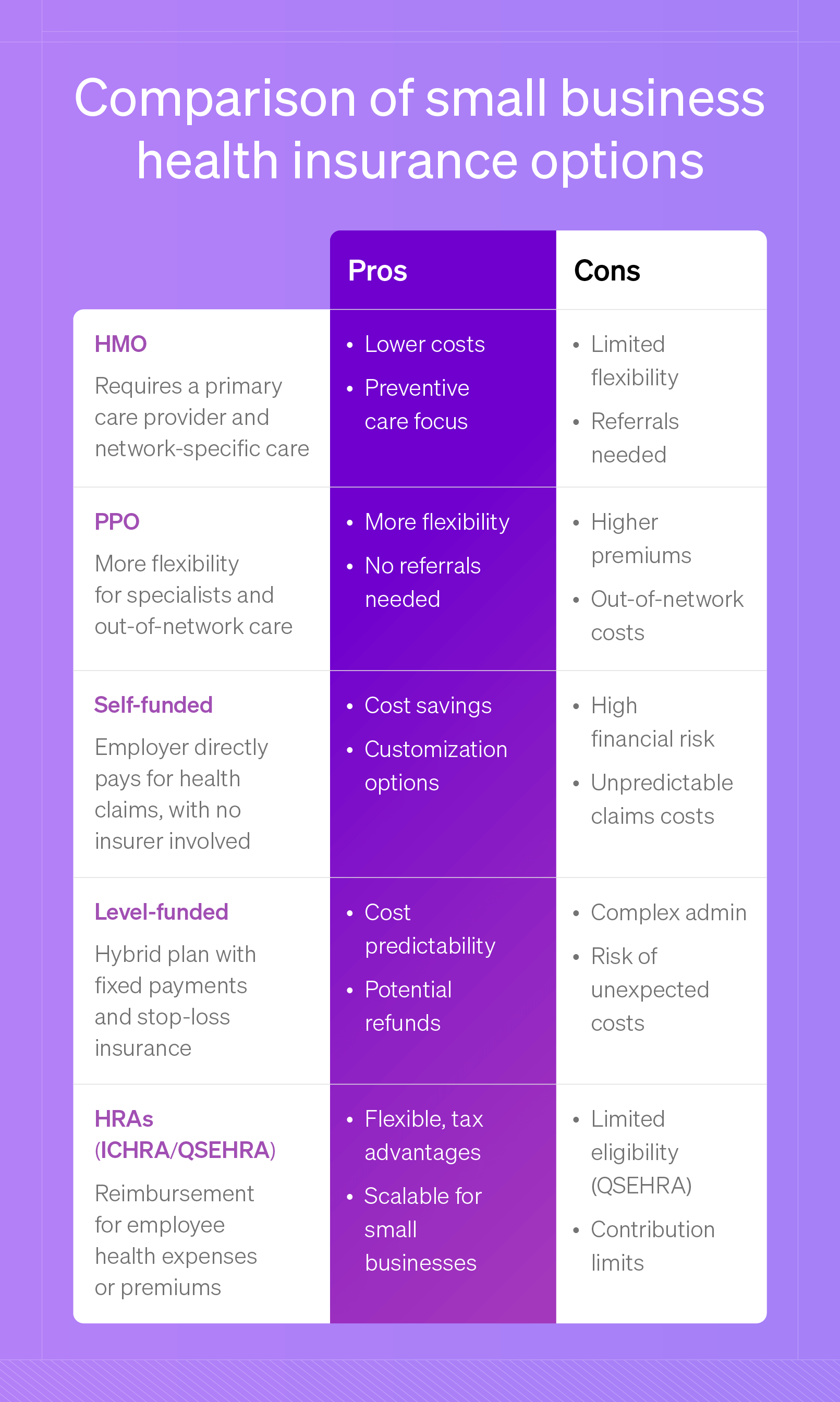

Types of Small Business Health Insurance

Small business owners have various choices, from traditional group plans to flexible, tax-advantaged options like Individual Coverage Health Reimbursement Arrangements, or ICHRAs.

Trending

Choosing the right plan for a small business depends on the company’s size, budget, and the level of risk owners are comfortable taking on. Here is a look at the primary types of small business health insurance plans available today.

![]()

Thatch

Small-Group Insurance (HMO, PPO)

Best for: Small businesses seeking straightforward plans with network-based coverage for all employees.

Small-group insurance is the traditional approach to employer-sponsored health coverage. It offers standardized plans through an insurer that covers all eligible employees. Those plans are often in the form of a Health Maintenance Organization, or HMO, or a Preferred Provider Organization, or PPO.

HMO is a plan that emphasizes preventive care and typically requires employees to use a specific network and select a primary care provider.

Pros:

- Lower premiums and out-of-pocket costs

- Emphasis on preventive care

Trending

Cons:

- Limited to a specific network of providers

- Requires referrals for specialist visits

The PPO plan offers greater flexibility to see specialists without referrals and allows for out-of-network care, albeit at higher costs.

Pros:

- Greater flexibility to see specialists without referrals

- Allows for out-of-network care

Cons:

- Higher premiums and out-of-pocket expenses

- Costs increase with out-of-network providers

Self-Funded Plans

Pros:

- Significant cost savings compared to traditional plans

- Flexibility to customize coverage to fit employee needs

- Avoids paying fixed premiums to insurers

Cons:

- High financial risk from unpredictable claims

- Requires resources to manage claims and compliance

- Stop-loss insurance may add additional costs

With self-funded (or self-insured) plans, businesses pay for employee health claims directly rather than through fixed premiums to an insurer.

While self-funding can offer substantial cost savings and customization options, it also comes with higher financial risk, especially if claims are unexpectedly high.

Best for: Businesses with the financial stability and resources to manage claims directly while seeking more control over plan design and costs.

Level-Funded Plans

Best for businesses with the financial stability and resources to manage claims directly while seeking more control over plan design and costs.

Level-funded plans are a middle ground between fully insured and self-funded plans, providing businesses with fixed monthly payments to cover expected claims and administrative costs. Businesses still self-fund but partner with a stop-loss insurer who takes over financial responsibility if claims exceed a pre-determined amount.

If claims are lower than expected, employers may receive a refund at the end of the year. This option offers more cost predictability than self-funded plans while still allowing for potential savings.

Pros:

- Fixed monthly payments provide cost predictability

- Potential for refunds if claims are lower than expected

- Includes stop-loss coverage to minimize financial risk

Cons:

- May require more administrative oversight than fully insured plans

- Refunds are not guaranteed if claims exceed expectations

Health Reimbursement Arrangements (HRAs)

Best for: Small businesses looking for a customizable, tax-efficient way to help employees with health care costs without managing a traditional group plan.

HRAs enable businesses to reimburse employees for medical expenses, offering flexibility and potential tax advantages. Businesses basically contribute funds to a tax-advantaged account that employees can use to pay for qualified medical expenses.

Two popular types of HRAs for small businesses include:

- Individual Coverage HRA (ICHRA): ICHRAs allow employers to reimburse employees for individual health insurance premiums and other qualified medical expenses on a tax-free basis. ICHRAs offer a flexible and scalable solution ideal for small businesses, especially for those hoping to avoid the cost and administration of a traditional group plan.

- Qualified Small Employer HRA (QSEHRA): QSEHRAs are similar to ICHRAs but have specific eligibility requirements. They are available only to businesses with fewer than 50 employees and do not offer a group health plan. Like ICHRAs, QSEHRAs allow for tax-free reimbursements but have annual contribution limits set by the IRS.

Pros:

- Flexible reimbursement for medical expenses or premiums

- Tax advantages for both employers and employees

- Reduces administrative burden compared to traditional group plans

Cons:

- Annual contribution limits for QSEHRAs

- Limited eligibility and compliance requirements

How to Choose the Right Health Insurance for Your Small Business

Choosing the best health insurance plan for a small business involves balancing cost, coverage, and ease of management. Here are a few important details to help guide the decision.

Budget

Start by setting a clear budget. As previously established, health insurance is a significant expense. Consider how much you’re willing to contribute each month and explore cost-control options like ICHRAs or level-funded plans, which can help with predictability.

Employee demographics

Employees’ needs should also play a role in this decision. Key factors to consider include:

- Age: Older employees or those with families might need more comprehensive coverage.

- Health status: If employees have chronic conditions, they may benefit from plans with low deductibles and robust coverage.

- Flexibility preferences: Some employees may prefer having the option to choose their own plan.

Compliance

Ensure the selected plan meets federal and state regulations. Small businesses with fewer than 50 employees are not required to offer insurance. However, those who choose to do so must comply with the Affordable Care Act (ACA), which requires them to cover essential health benefits and meet minimum value standards.

Network coverage

Consider the plan’s network, especially if employees live in different areas. A plan with a national network or a flexible PPO may be best for a geographically diverse workforce. HMOs, while more affordable, may restrict employees to a smaller network of providers.

Administrative burden

Some plans are simpler to manage than others. Here’s a quick comparison:

- Traditional group plans: Often require more ongoing management and compliance oversight.

- HRAs: Offer flexibility, allowing employees to manage their own coverage, which can reduce administrative tasks.

- Self-funded and level-funded plans: These may require a third-party administrator but can offer savings and customized plan design.

Carefully evaluating these aspects can ensure you choose the best health insurance solution for your business.

How Do These Options Work?

Understanding the mechanics of small business health insurance plans can help to choose the right fit for a business. Each type of plan has unique features, but the general processes for enrollment, premium payments, and claims administration are relatively consistent across options:

Enrollment

Employees can sign up for coverage or update their choices during an annual open enrollment period. The employer may offer different plan options with varying levels of coverage and costs.

Employers may work with an employee benefits broker to navigate the selection and enrollment processes, ensuring compliance with healthcare regulations.

Paying premiums

With traditional group plans and HRAs, employers typically pay a portion of the premium, with employees covering the remaining cost through payroll deductions.

Level-funded plans have a fixed monthly payment that combines premium costs and expected claims.

Self-funded plans don’t involve regular premiums. Instead, employers cover employees’ claims as they arise, which can fluctuate based on healthcare usage.

Claims administration

When employees incur medical expenses, they submit claims to the insurance company for traditional plans, an HRA administrator, or a third-party administrator (TPA) for self-funded and level-funded plans.

The employee’s plan then determines their specific coverage and pays the provider or reimburses the employee directly.

Employer and employee responsibilities

The responsibilities of employers and employees vary slightly depending on the plan structure.

Employers cover a portion (or all) of the premiums or reimbursement costs and ensure the plan meets regulatory requirements.

Employees are responsible for choosing appropriate providers and managing out-of-pocket costs, such as deductibles or copays.

For ICHRAs and QSEHRAs, employees must select their health insurance policies, which gives them more control and responsibility over their health care coverage.

Thatch

Average Costs of Small Business Health Insurance

According to the Kaiser Family Foundation, health insurance premiums for family coverage rose by 7% in 2024, marking one of the highest increases in recent years.

Several factors are at play in determining the cost of small business health insurance, each of which can cause these premiums to vary widely:

- Industry: High-risk fields, like manufacturing or construction, tend to have higher premiums, while lower-risk sectors, like tech, usually pay less.

- Location: States with higher health care costs and more regulations, such as New York and California, often have more expensive premiums.

- Employee demographics: Older employees or those with chronic conditions may increase average premium costs.

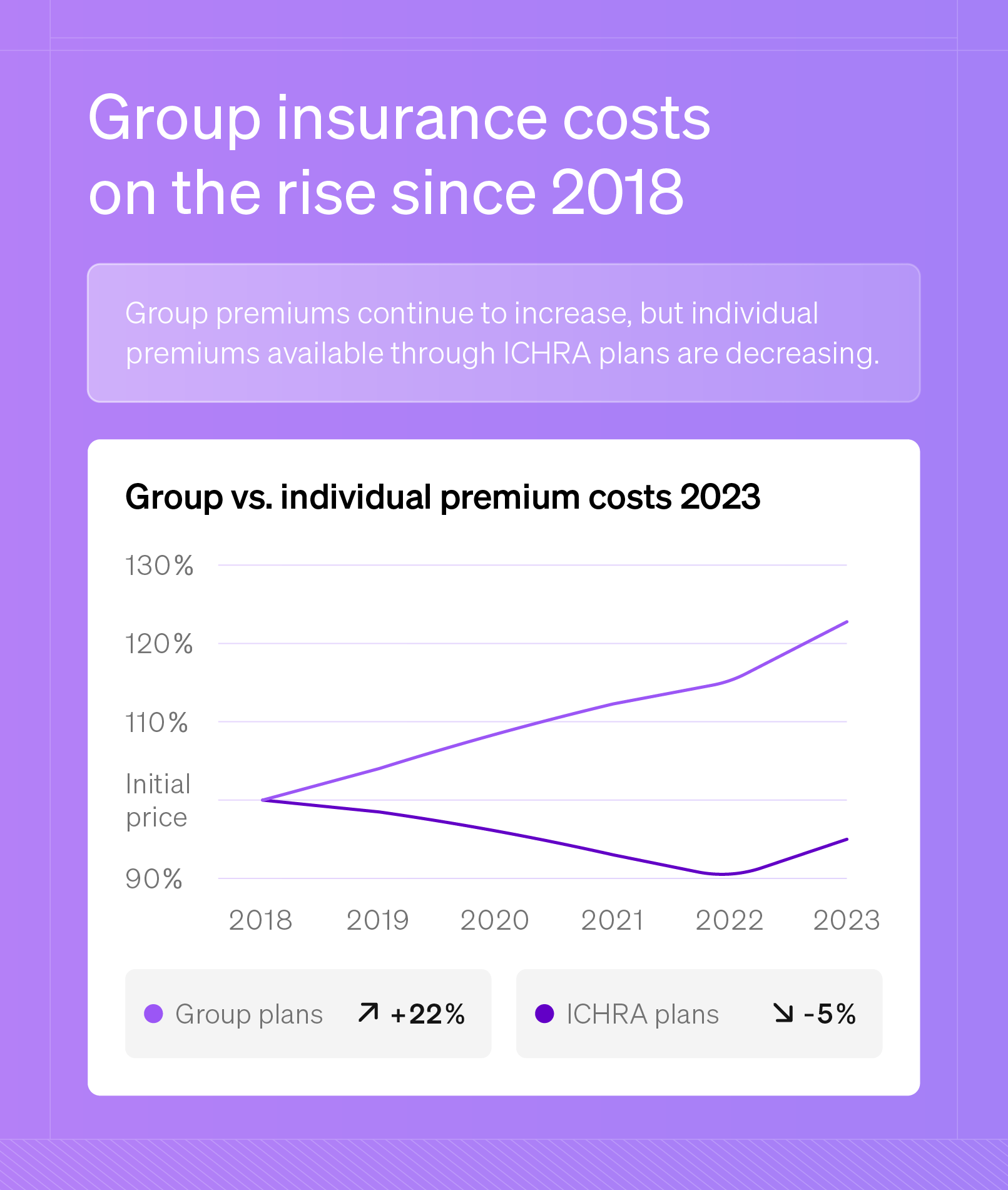

Plan design also impacts costs. For instance, choosing an ICHRA can lower costs by reimbursing employees for individual insurance. Premiums for ICHRA plans decreased by 5% from 2018 to 2023.

In comparison, traditional group plan premiums have risen by 22% over the same period.

Understanding health insurance pricing is crucial for setting realistic expectations and budgeting effectively. When analyzing the costs associated with small-group plans, the KFF 2024 Employer Health Benefits Survey found:

- Employers: Premiums cost an average of $9,131 annually for single coverage and $25,167 for family coverage.

- Employees: Contributed an average of $1,204 annually for single coverage and $7,947 for family coverage.

Self-funded and level-funded plans offer alternatives for businesses seeking more control over their health care costs. These plans can vary widely in cost, depending on factors like claims experience and risk tolerance. If claims are low, there is savings potential for both employers and employees.

Additional factors like deductibles, copays, and coinsurance also affect the total cost for both employers and employees. An employee benefits broker can help obtain specific quotes tailored to a company’s needs. This approach helps ensure the chosen plan aligns with budget and coverage goals.

4 Best Health Insurance Providers for Small Business

A few health insurance providers consistently offer strong coverage options for small businesses. Thatch identified four leading health insurance providers that offer flexibility, comprehensive coverage, and a range of plan types to meet diverse needs.

Kaiser Permanente

Kaiser Permanente is known for its integrated care model, offering both insurance coverage and health care services through its own network of hospitals and physicians.

Features include:

- High-quality care coordination within Kaiser facilities

- Affordable HMO plans with predictable costs

- Strong presence in areas like California, Colorado, and the Pacific Northwest

Anthem

Anthem provides a wide range of plans, including HMO, PPO, and high-deductible health plans, or HDHPs , making it a flexible choice for businesses of varying sizes.

Features include:

- A broad network of providers across multiple states

- Digital tools and telemedicine options for easy access to care

- Customizable plans to meet different budgets and coverage needs

United Healthcare

United Healthcare is popular for small businesses, offering comprehensive plan options and a large provider network.

Features include:

- Access to one of the largest provider networks in the U.S.

- Wellness programs and health management tools to support employee well-being

- Extensive telehealth services, allowing remote care options

BlueCross BlueShield

BlueCross BlueShield operates through a network of regional branches. Florida Blue, BlueShield of California, and Blue Cross Blue Shield of Texas are just a few of them providing localized coverage with national reach.

Features include:

- Customizable plans offered by regional branches to meet local market needs

- Strong nationwide network through the BlueCard® program for coverage across states

- Excellent support for businesses with employees in multiple locations

Each of these providers offers unique strengths, allowing small businesses to choose the best plan for their situation.

FAQ

Do small businesses have to provide health insurance to employees?

Small businesses are only required to provide health insurance to employees if they have 50 or more full-time employees. In this case, they must comply with the ACA’s employer mandate.

Can small businesses write off health insurance?

Yes, small businesses can typically deduct the cost of health insurance premiums as a business expense. This applies to both group health plans and individual plans for owners and employees.

Consult with a tax professional to understand the specific deductions available to your business.

What is the best option if an employee has a pre-existing condition?

The best option for employees with pre-existing conditions is to offer a health insurance plan that covers them without exclusions, such as an individual plan through the marketplace. An ICHRA is another good choice since it allows employees to choose their own coverage.

Under the Affordable Care Act, insurers cannot deny coverage or charge higher premiums based on pre-existing conditions.

Empower Your Small Business With ICHRA

Offering competitive benefits to your employees is valuable. However, determining which type of health insurance is best for a company and its staff may be overwhelming.

ICHRAs offer a flexible and cost-effective solution for attracting and retaining top talent. By reimbursing employees for individual health insurance premiums, they can help companies attract and retain top talent without breaking the bank.

This story was produced by Thatch and reviewed and distributed by Stacker.