Car buyers and credit: What auto financing means for credit scores

Published 3:30 pm Tuesday, December 17, 2024

Car buyers and credit: What auto financing means for credit scores

Car loans are one of the most common types of debt among consumers in 21st century America. While auto loans are not as common as credit cards, the majority of Americans (62%) have an auto loan in their name as of the second quarter (Q2) of 2024, according to Experian data. This speaks not only to the ubiquity of car culture in the U.S. but to the accessibility and affordability of auto loans to cover the purchase of a new or used vehicle.

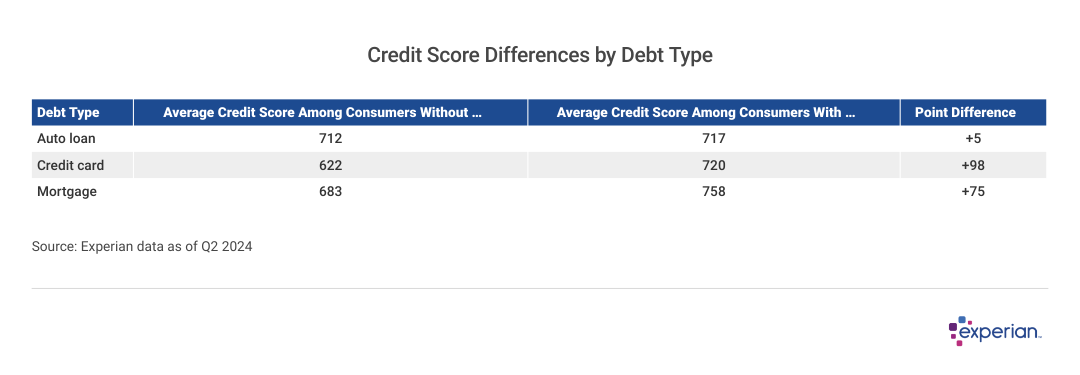

In a review of anonymized and aggregated consumer data, Experian found that credit profiles of auto loan borrowers do not differ significantly from those who don’t have an auto loan in their name. In fact, average credit scores among the two groups of consumers were far more similar than for consumers using—or not using—other credit products, like credit cards and mortgages.

![]()

Experian

Average Credit Score Among Car Loan Borrowers Nearly Identical to Non-Borrowers

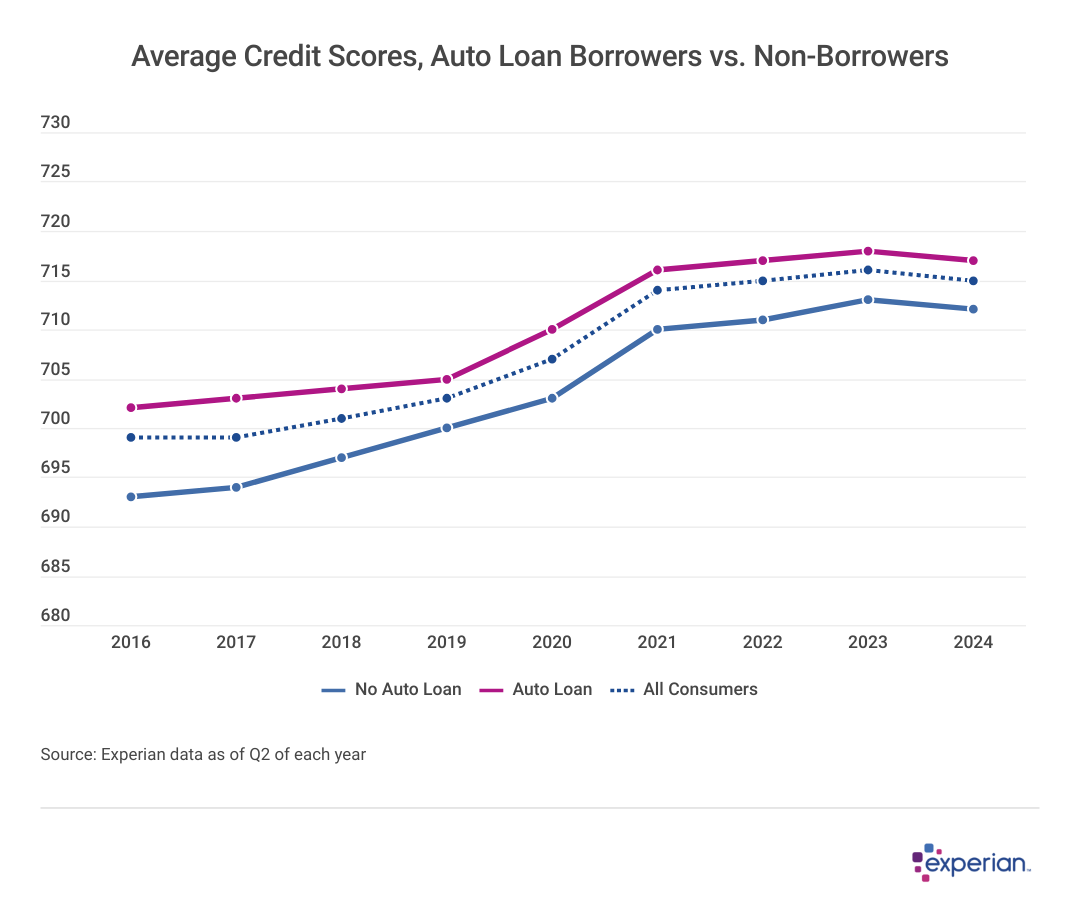

When Experian compared the credit scores of car buyers who finance their ride with auto loans or lease from the dealer, it wasn’t too surprising to see that the difference between the average credit scores of those with auto payments was minimal. Since 2016, the difference in average credit scores between those with and without auto payments ranged from five to nine points—a barely meaningful difference in creditworthiness.

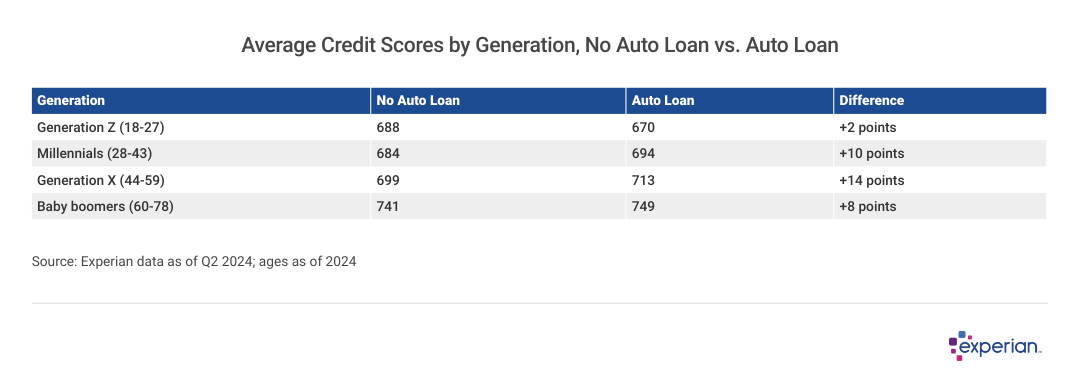

Drilling down further, average credit scores by age for auto loan holders are similarly spaced, whether it’s a first-time Gen Z driver or baby boomer on their 15th Toyota Camry. For each generation, having a car loan suggests a slightly higher credit score, but not by much.

Experian

Auto Loans vs. Other Debt: The Credit Score Gap Explained

Compare the differences in the auto loan haves and havenots to those with other types of loans, such as mortgages, and there are generally larger differences among borrowers and non-borrowers. Even credit cards, which are more common than auto loans, show a vastly wider difference in average credit scores between those who carry them and those who don’t.

Experian

What Is It About Auto Loans That Levels the Credit Playing Field?

Consumers in nearly all major demographic types use auto loan financing, regardless of income, age or even the type of vehicle financed. Urban dwellers may be the only demographic for whom auto loans aren’t necessarily a part of most consumers’ lives. But nearly everywhere else, being a pedestrian is at least a disadvantage if not outright an impossibility to be able to fully participate in the community and labor force.

However, the fact that auto loans can be relatively easily collateralized (in other words, payment delinquency can quickly lead to repossession) means lenders are more able to serve a wider range of consumers—including riskier borrowers—than those who offer consumers unsecured loans. Consequently, there are lending markets that serve all levels of credit risks, unlike with other loans.

Auto Lenders Serve a Wide Range of Borrowers

For most types of credit, such as mortgages and credit cards, lenders typically approve borrowers with credit scores above a certain level, such as 620 for most conventional loan mortgages and often higher than that for many credit cards.

For auto loans, however, lenders cater to a wide range of consumers, with a wide range of credit profiles—more so than virtually any other type of credit. Borrowers often receive a wider range of offers from lenders, whether they’re from the dealer’s office or a local credit union. This is especially true in areas where an automobile is essential to accomplish daily activities.

For example, as of November 2024, numerous auto manufacturers were offering 0% financing for many new car models to “well-qualified buyers.” While well-qualified may vary from offer to offer, quite likely, it means having a very good credit score, at a minimum. In FICO Score terms, a very good score ranges from 740 to 799.

At the other end of the market, drivers with less than very good credit can also receive financing, albeit at sometimes less-than-favorable credit terms. Drivers with fair and even poor credit can sometimes find auto loan financing, even with credit scores that make them unqualified for other types of consumer credit, like an unsecured credit card.

Auto Loans Are Collateralized, Unlike Some Other Types of Debt

Collateral is how auto lending became an especially distinct type of consumer lending in the U.S., as $1.1 trillion in auto loans are secured by a fleet of 80 million vehicles as of Q2 2024. If a borrower continues to miss auto payments, it typically isn’t long before severe credit delinquencies and other consequences, up to and including repossession, are triggered. This allows lenders, should they choose, ways to offer loans to borrowers with lower credit scores while keeping their financial risk to a minimum.

Autos Are Purchased and Financed With Regularity

Most drivers in the U.S. will drive several different cars or trucks in their lifetime—although drivers are collectively hanging on to cars longer than usual. The average age of cars on the road is currently 14 years, three years longer than in 2010, according to data from Standard & Poor’s.

However, those decade-old cars are often financed more than once, as anyone who’s perused a Carfax report or visited a used car dealer can attest. Perhaps only at the very end of their time on the road do these very used cars result in all-cash transactions. For most other transactions, there’s another auto loan, either from a dealer or a bank or credit union.

The Asset That Keeps Depreciating

In practically all cases, the market value of a car or truck only declines over time, as time, miles and potholes take their toll on both daily and Sunday drivers alike. Over time, drivers who are financing their vehicle will likely lose 50% or more of its value over the life of their car loan—the average term of which is now approaching 72 months.

That level of depreciation is one possible reason that more consumers are turning to auto leasing to get their hands on a car, according to Experian data. They may walk away with nothing after three years, but at least they won’t have a much-depreciated asset lingering in their garage.

With vehicles continuing to get more expensive, the effects of this depreciation will become more exaggerated on consumers’ pocketbooks. Whether drivers choose to deal with that depreciation by looking for other options, including loans, or by driving their cars long past their loan payoff date remains to be seen. If another car loan is in their future, their credit score is an important factor in how much they’ll pay—even if it isn’t the main deciding factor in whether they get a loan at all.

This story was produced by Experian and reviewed and distributed by Stacker.