How a home warranty protects your home, even if you have home insurance

Published 1:30 pm Monday, July 21, 2025

How a home warranty protects your home, even if you have home insurance

New homeowners know that home insurance is an important (and often required) policy for home purchases. But did you know that a home warranty is also vital to protecting your most important asset?

A home warranty offers budget protection against unexpected, covered repair costs for major parts of home systems and appliances – for example, your heating and air conditioning (HVAC) system, electrical system, refrigerator or washer/dryer.

With dozens of providers offering a wide range of plans, choosing the right company and understanding what is—and isn’t —included in your coverage is essential. American Home Shield outlines the benefits of home warranties and what to consider when comparing home warranty companies.

What is a home warranty and how is it different from home insurance?

Trending

A home warranty is a service contract that can cover the repair or replacement of parts of covered major home systems and appliances when they break down due to normal wear and tear. Home insurance can cover damage from major events such as a flood, fire or hurricane.

While home insurance covers your home in the event of disasters that might happen, a home warranty protects against the inevitable: it’s simply a matter of time before appliances or systems break and need to be repaired.

Why homeowners should have a home warranty.

The cost of buying a home isn’t confined to a down payment, mortgage and taxes. The expense of maintaining a home also needs to be considered. In a recent survey of homeowners about their experience buying their first home, about half (49%) of respondents said they wished they had considered maintenance needs more before purchasing.

American Home Shield

The rising cost of goods due to tariffs is also adding to financial anxiety for homeowners. According to a U.S. News survey of 1,200 homeowners conducted in April 2025, 80% of homeowners are concerned rising global costs will increase appliance replacement expenses.

Homeowners insurance will not protect against these added maintenance costs, but a home warranty can help. This type of coverage can offer peace of mind by helping to pay for some common costs associated with homeownership due to breakdowns, particularly if a home is older.

Trending

Home warranties can also provide discounted seasonal tune-ups, which is key to helping keep unexpected breakdowns—and warranty claims—to a minimum.

“We tend to see a spike in HVAC calls during the first heat wave of summer and the first cold snap of winter—right when systems are pushed to work the hardest,” says Micah Sherman, a virtual HVAC expert with Frontdoor. “But just like annual wellness visits can help people avoid major health emergencies, scheduling regular maintenance for your HVAC system can help prevent a lot of stress, unexpected breakdowns and warranty claims down the line.”

Choosing a home warranty company and coverage that fits your needs.

Homeowners should take the time to research providers, read sample contracts and take a close look at coverage details and contract terms. Melanie McGovern, director of public relations for the Better Business Bureau, says that it is crucial to ask questions and understand what is and is not covered in your contract to ensure you have a positive experience.

“Really ask questions—to the point of being super-persistent,” McGovern says, and make sure the company gets back to you with answers. “If you can work with a company that has great customer service, that will go a long way to saving you money down the line.”

Here are a few additional factors to consider when choosing a provider:

- Evaluate coverage details and limitations. Always read the fine print. Learn if there are caps on repairs, exclusions or additional service fees. Some homeowners may also want to look into optional add-ons for items like pools or septic systems.

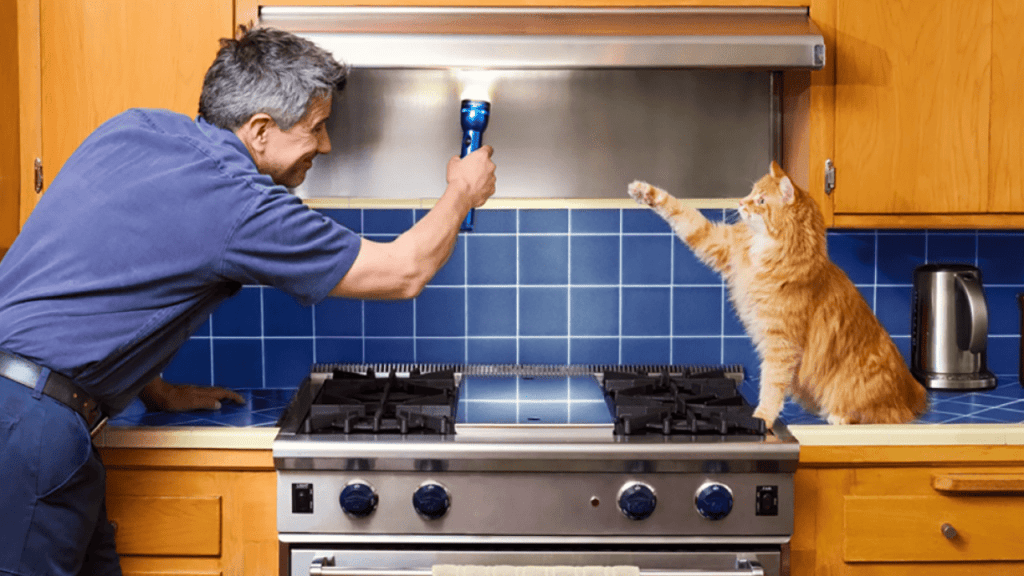

- Is digital access important to you? Many providers have digital tools to streamline service requests and improve customer experience. Look for companies with mobile apps or online portals for filing claims and managing coverage. You may even be able to video chat with an expert before you decide whether to have a contractor come to your home.

- Review independent ratings and consumer feedback: personal recommendations are valuable, but also check impartial, credible sources for reviews. Use neutral sources such as Consumer Reports or J.D. Power for objective evaluations. For example, CNBC recently published its list of the Best Home Warranty Companies for 2025.

After careful consideration, attention to contract details and a priority on quality, homeowners will be empowered to choose a home warranty plan that best aligns with their needs and helps protect against costly home repairs.

This story was produced by American Home Shield and reviewed and distributed by Stacker.

![]()