How artificial intelligence could solve America's debt crisis

Published 9:45 pm Wednesday, July 30, 2025

How artificial intelligence could solve America’s debt crisis

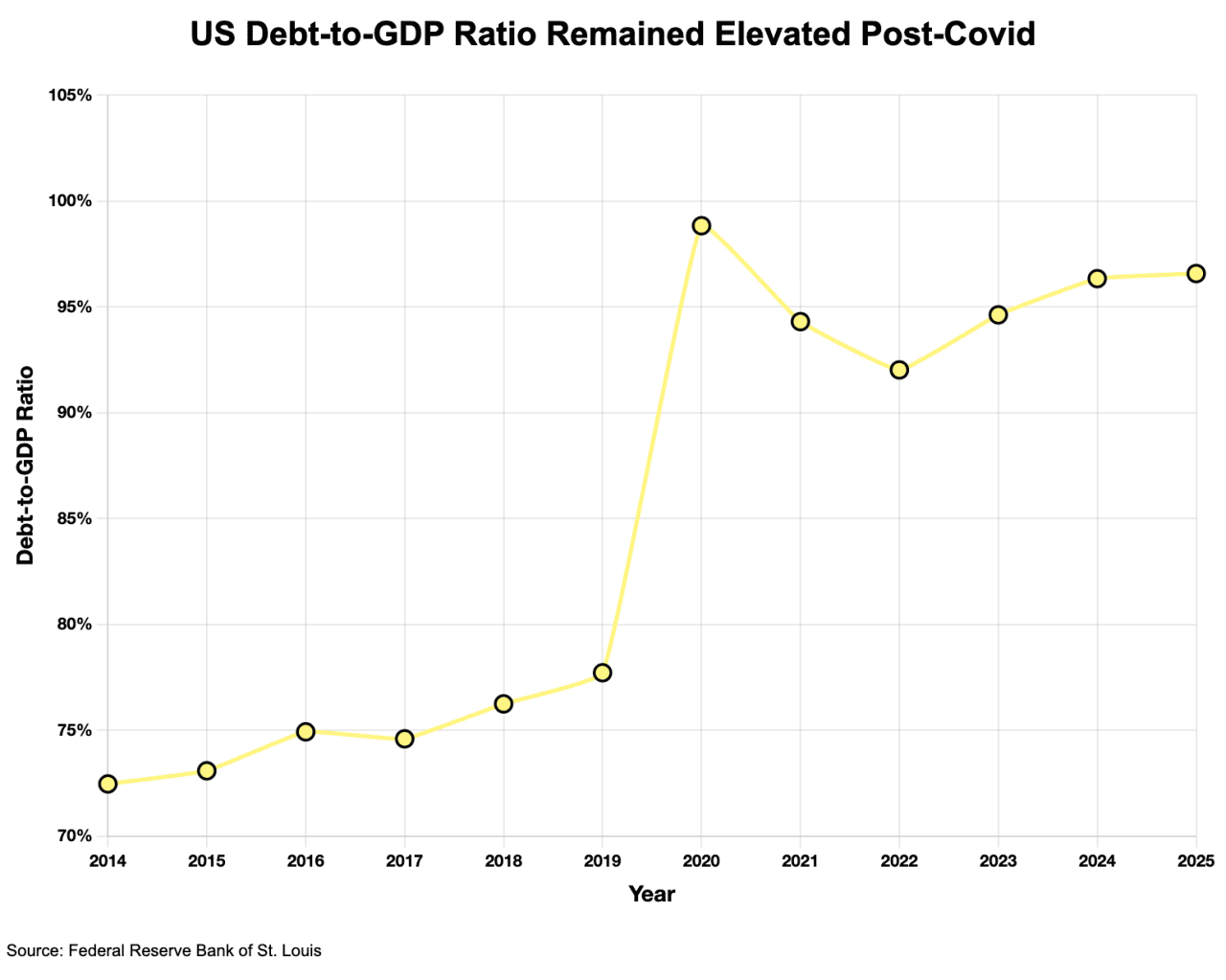

With the enactment of the One Big Beautiful Bill pushing America’s debt-to-GDP ratio further into dangerous territory, a sudden political pivot towards fiscal discipline seems unlikely. Policy-makers have made it abundantly clear that they are not going to stop spending.

Economists have responded by projecting our debt/GDP levels will go from nearly 100% today to 120%+ over the next 10 years. Only countries like Italy, Greece, Sudan, and Japan are in a worse position. The market’s response? Long-term interest rates are at the highest level in nearly 20 years, impacting mortgage rates, the cost of student loans, and corporations’ ability to borrow money and create jobs.

Key Takeaways

- AI productivity gains could solve America’s mounting federal debt crisis through GDP growth.

- Artificial intelligence delivers disinflationary pressure while boosting tax revenues and economic output.

- U.S. debt-to-GDP ratio approaching 120% requires AI-driven productivity revolution for stabilization.

- Technology innovation creates net job growth despite automation, with 78 million new roles projected.

Trending

With the enactment of the One Big Beautiful Bill pushing America’s debt-to-GDP ratio further into dangerous territory, a sudden political pivot towards fiscal discipline seems unlikely. Policy-makers have made it abundantly clear that they are not going to stop spending.

Economists have responded by projecting our debt/GDP levels will go from nearly 100% today to 120%+ over the next 10 years. Only countries like Italy, Greece, Sudan, and Japan are in a worse position. The market’s response? Long-term interest rates are at the highest level in nearly 20 years, impacting mortgage rates, the cost of student loans, and corporations’ ability to borrow money and create jobs.

Range

With no spending restraint in sight, the most compelling argument for optimism lies not in Washington but in Silicon Valley—and increasingly, in every sector of the economy that’s beginning to harness artificial intelligence.

Range sees one credible path to stabilize this debt burden and put a ceiling on long-term rates: AI-driven productivity gains.

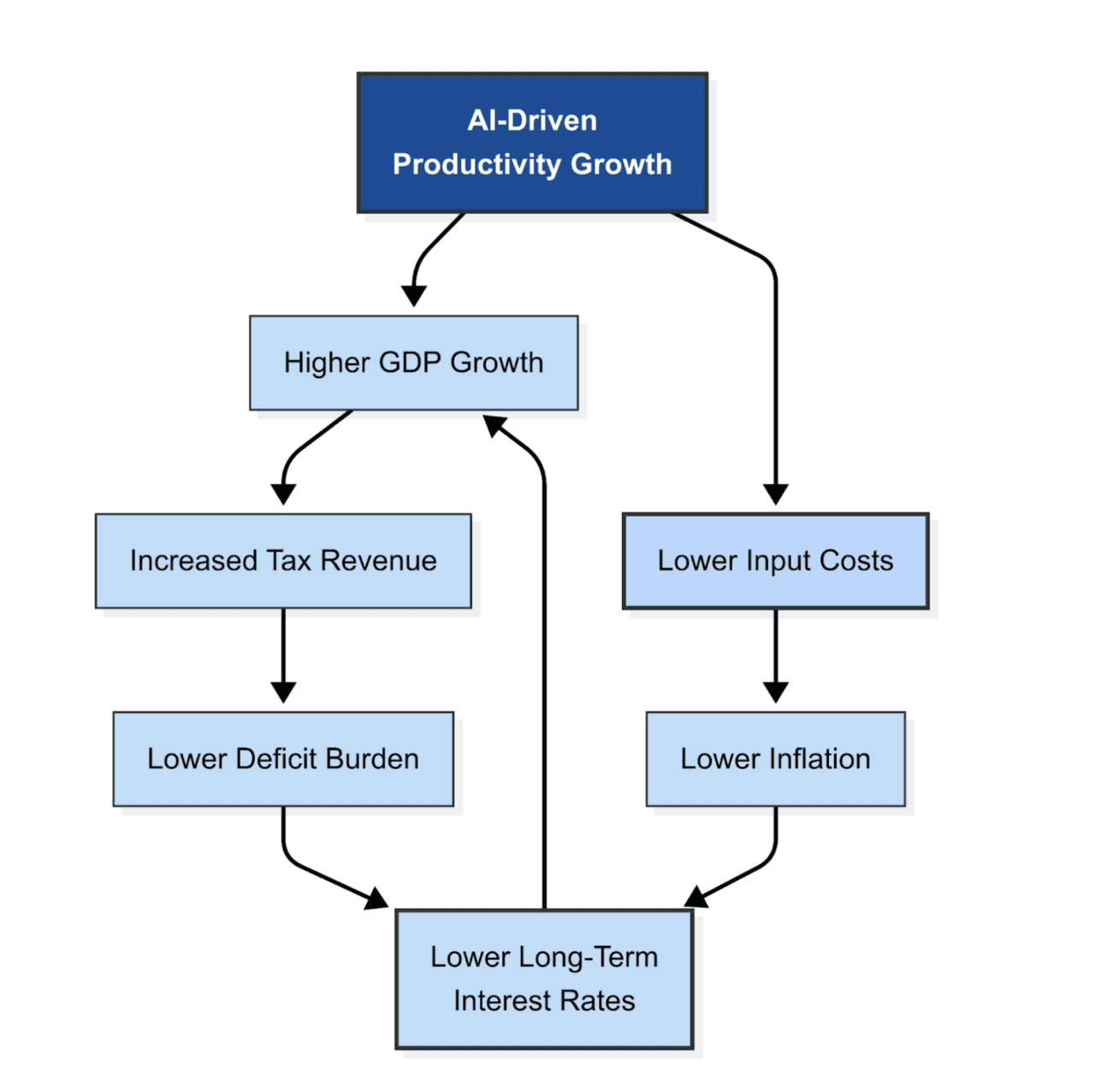

Just like in any household, Americans can afford to spend more as a country if they’re making more income. AI-driven increases in productivity could accelerate GDP growth while also reducing inflation and bringing down interest rates. Higher growth and lower interest rates as a result of AI could be a panacea for the markets.

Why Productivity Matters

Trending

Here’s some context on the relationship between productivity and GDP. While there are several models to measure and forecast GDP, a simple one that the Congressional Budget Office uses for its own long-term GDP projections assumes:

Real GDP Growth = Labor Growth(x labor contribution) + Capital Growth(x capital contribution) + Productivity

Of these variables, changes in productivity have the largest impact on GDP growth. Technological innovation has been the driver of productivity over the course of history.

Enter AI: The Great Productivity Catalyst

Artificial Intelligence is not an incremental innovation—this is not akin to going from 4G to 5G cellular service. AI is a general-purpose technology revolution on par with the steam engine, electricity, or the internet itself.

Groundbreaking technology like this one has a way of setting the economy into hyperdrive. From the 1970s to the early 1990s, productivity growth languished below 1%. Then came the dot-com revolution, and productivity exploded toward 2%. That technological shift played a key role in creating a virtuous economic cycle that helped drive the budget surpluses of the late 1990s.

The AI productivity thesis works through multiple channels:

- Direct Economic Growth: AI-driven productivity gains can translate directly into higher GDP. When the same inputs produce more output, the economy grows faster without requiring additional resources.

- Increased Tax Revenues: Higher productivity usually leads to higher corporate profits, wages, and economic activity—all of which generate increased tax receipts. More government revenue means less need to borrow.

- Disinflationary Pressure: Less government borrowing leads to lower inflationary pressure. In addition, productivity improvements reduce the cost of producing goods and services, which slows down inflation.

- Improved Debt Dynamics and Lower Rates: Lower inflation allows the Federal Reserve to maintain a more accommodative monetary policy. In addition to stimulating the economy through cheaper borrowing costs, lower interest rates allow the government to spend less on interest expense and redeploy those funds back into the private sector instead, further stimulating the economy.

Range

A combination of higher GDP and lower debt growth improves the debt-to-GDP ratio from both sides of the equation. If AI delivers even modest incremental productivity gains of 1-1.5% annually, the U.S. could potentially maintain or reduce current debt-to-GDP levels despite continued spending growth.

This isn’t far-fetched—there are already measurable productivity improvements as AI tools become integrated across industries. As AI adoption increases, these productivity gains could permeate through the economy and allow the U.S. to “grow its way” out of the current fiscal hole it’s in even if the spending addiction is never addressed.

Will AI Take Our Jobs?

The potential positives of AI-led productivity are meaningful, but at what cost will Americans see these benefits? Many want to know: “Will AI take our jobs?”

If history is any guide, the answer is…“probably”. In the early 1800s, around 70% of the population was employed in agriculture. Today, on-farm workers represent less than 2% of the workforce. Similarly, in the 1950s, around 30% of workers were employed in manufacturing jobs. Today, that number is less than 10%

But throughout history, when technological innovation eliminates jobs, it creates new ones as well. Remarkably, 60% of the jobs people are employed in today didn’t exist in 1940. That means nearly 90% of employment growth over the last 80 years resulted from technology creating entirely new categories of work.

This pattern is already emerging with regard to AI. Companies are beginning to hire prompt engineers, AI ethicists, and image annotators who train machine learning models. At Range, we’ve hired CFPs, CPAs, and CFAs as critical subject matter experts working alongside our engineers to help build and validate our AI-powered technology. These aren’t traditional roles—they represent the emergence of new types of knowledge workers who combine domain expertise with technological fluency.

In aggregate, while technological innovation has led to significant gains in productivity, there are more people employed today than ever, and the unemployment rate is low by historic standards. The World Economic Forum’s Future of Jobs Report estimates macrotrends like artificial intelligence and related technologies will create 170 million new jobs globally by 2030, while displacing 92 million existing roles, signaling a net gain of 78 million new roles this decade. In spite of fear-mongering often seen from the media, the country could see the advancement of AI bolster job growth as opposed to derailing it.

Bumps Along the Way

The path outlined may not be linear. AI-led productivity gains might take longer to materialize than anticipated, or could initially be concentrated in fewer sectors than hoped. Markets may struggle to price the timing and magnitude of AI’s impact on productivity while grappling with current fiscal realities. In the meantime, elevated rates and other inflationary pressures may hamper economic growth and tighten access to capital markets, delaying the innovation cycle.

Disruption is also expected with a volatile transition period. Not everyone will benefit at the same time or in the same way. For every “AI Winner”, there may be a Kodak or a Best Buy—companies that don’t make it along the way. Furthermore, ensuring these productivity gains translate into broad-based wage growth will be critical. If the benefits are concentrated among a small number of firms and capital owners, it could exacerbate different societal challenges.

But people are already witnessing the very real positive effects AI is having on some of the world’s largest and most impactful companies. These organizations are demonstrating measurable increases in productivity and capacity while simultaneously lowering operational costs—and markets are rewarding these improvements with significant share value appreciation.

The Path Forward

The debt problem is real, and lawmakers are not acting to address it. But rather than resigned pessimism, the AI revolution offers a plausible path toward economic growth that could outpace our debt accumulation. Technological innovation has historically provided solutions when political processes have reached impasses, and that could be exactly what bails us out.

For investors navigating today’s technological and fiscal climate, it’s as important as ever to have diversified portfolios. However, maintaining significant exposure to U.S. markets is key—a growing deficit should not deter this. The U.S. has commanding advantages in AI and tech development: It is a global leader in R&D spending and houses the majority of the world’s top AI researchers. The largest and most innovative technology companies remain U.S.-based and continue posting impressive growth rates. It’s important to maintain exposure to these extraordinary businesses.

The question here isn’t whether AI will transform the economy—that’s already happening. The question is whether this transformation will occur quickly and broadly enough to provide the productivity growth needed to save our economy from potentially falling into a debt spiral. Based on current trajectories, there’s substantial reason for optimism.

This story was produced by Range and reviewed and distributed by Stacker.

![]()