Man, woman sentenced to more than 5 years in prison, $10.6 million in fines for receiving fraudulent COVID-19 loans

Published 3:58 pm Wednesday, September 11, 2024

Two Mississippi residents have been convicted of defrauding the Small Business Administration (SBA) by applying for and receiving fraudulent Economic Injury Disaster Loans during the COVID-19 pandemic. The convictions were announced following a three-day trial.

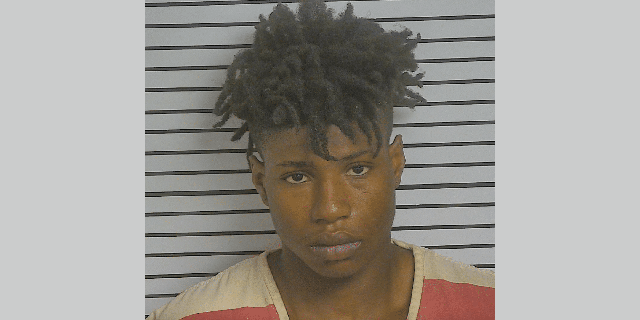

Ramirez Ivy, a former West Point officer from Columbus, and Felicia Smith, of Clarksdale, were found guilty of conspiracy to commit wire fraud and aiding and abetting wire fraud. According to court documents, Ivy and Smith conspired with others, including former SBA employee Lekeith Faulkner and Norman Beckwood, to file fake loan applications that falsely claimed non-existent business revenue. Each received $200,000 from the fraudulent applications.

Faulkner and Beckwood both pled guilty to conspiracy charges earlier and were sentenced to 62 months in prison, followed by five years of supervised release. The two were ordered to pay $10.6 million in restitution to the SBA. Beckwood also forfeited assets, including over $700,000 and two luxury vehicles.

The scheme, which involved 30 other individuals, was uncovered through a civil investigation led by the U.S. Attorney’s Office. The fraud targeted emergency loan programs intended to assist businesses impacted by the pandemic, resulting in significant financial losses to the government.

The case was prosecuted by Assistant U.S. Attorney J. Harland Webster.