College enrollment is declining. Is the botched FAFSA rollout to blame?

Published 7:30 pm Tuesday, December 17, 2024

College enrollment is declining. Is the botched FAFSA rollout to blame?

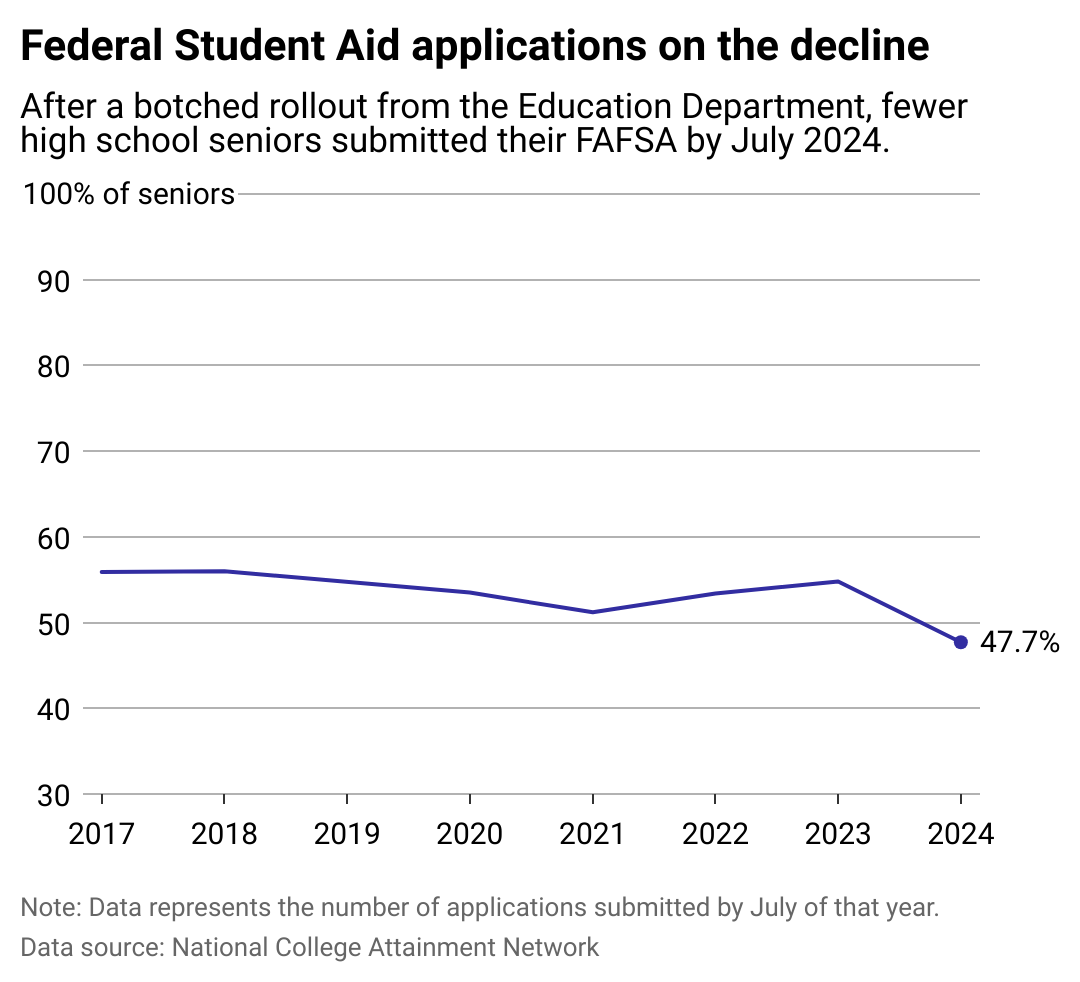

A new federal financial aid application rollout was supposed to streamline a complex college application process for students and families. Instead, it created chaos. The Free Application for Federal Student Aid, or FAFSA forms, which historically launched on Oct. 1, weren’t released until Dec. 30, 2023, and had numerous technical difficulties.

This delay meant some students were unable to start or complete their applications, schools lacked the information needed to put together timely financial aid packages, and the Department of Education failed to answer 4 million calls for help, which was nearly three-quarters of the total calls, according to a Government Accountability Office review.

ScholarshipInstitute.org examined data from the National College Attainment Network and other sources to determine how the Education Department’s botched rollout of new financial aid or FAFSA forms affected undergraduate enrollment.

According to the National Student Clearinghouse Research Center, first-year enrollment fell 5% in the fall of 2024, and four-year public and private nonprofit schools experienced the most significant slump.

“That is a reversal of last year’s growth, taking the size of the freshman class back to pre-2022 levels,” Doug Shapiro, the executive director of Clearinghouse’s research center, said at a press briefing releasing the results.

The new rollout came after Congress ordered the Department of Education to improve the way students applied for financial aid. The department was supposed to obtain a family’s financial information directly from the IRS and slash the number of questions it asked, according to the GAO review.

But some students and parents found their financial aid eligibility was miscalculated, and the entered information was deleted. The review found that the Department of Education counted more than 40 technical problems and failed to tell students how long the issues would take to resolve.

The review noted that the delayed release date also held up financial aid offers from colleges and rushed enrollment decisions. Some colleges, such as Drexel University, missed enrollment targets, which led to staff and benefits cuts and consolidation to close the budget gap. Smaller schools such as Hampshire College also point to the FAFSA fumble as one reason for their budget woes, according to Inside Higher Ed.

The FAFSA application was delayed again this year—it was made available to students on Nov. 21—but it appears to be working without last year’s problems, said Bill DeBaun, senior director for data and strategic initiatives at the National College Attainment Network. Going forward, Congress set Oct. 1 as the deadline for when the form must be available.

![]()

ScholarshipInstitute.org

FAFSA applications plummet

After the problem-plagued FAFSA revision, the number of students who completed a FAFSA form as of Oct. 18, 2024, was down more than 9% compared to the year before. That’s an important number because there is a well-established connection between a completed FAFSA form and enrollment, DeBaun said.

The data from the Clearinghouse research center shows that not only did fewer 18-year-olds head to college, but the colleges that saw the most dramatic declines had many low-income students.

First-year enrollments fell at four-year schools with a notable number of students receiving Pell Grants—government subsidies to pay for college. Meanwhile, enrollment rose slightly at other community colleges, according to the research center.

Affordability is the #1 concern for students and their families when they consider college, DeBaun said.

“For a lot of students and families, it is not a question of whether or not they want to go to college; it’s a question of whether they feel like they can pay for it,” he said, noting that FAFSA is the key for federal and state institutional aid. “That aid is what makes it possible for many students and families to afford college education.”

Particularly when the economy is in a downturn, some families question whether college is within their budget at all. Between 2010 and 2021, for example—right after the Great Recession through part of the coronavirus pandemic—total undergraduate enrollment fell 15%, with much of the decrease occurring during the pandemic, according to the Department of Education’s Report on the Condition of Education 2023.

In a 2023 Brookings commentary, author Katharine Meyer pointed to a Wall Street Journal/NORC poll published the same year that found the number of adults who said a four-year degree was not worth the price rose to 56% from 40% a decade earlier. Possible reasons for the rise include exorbitant student debt and the strong labor market, even for those who did not attend college.

But, a college education remains a good investment, with graduates earning more and finding themselves unemployed less often, Meyer noted.

DeBaun said that the education community must help students and their families explore whether college is worth the cost and determine which post-secondary programs will likely provide a positive return on their investments in terms of jobs and earnings.

“There is an economic imperative in this country to produce more college-educated professionals,” he said. “We have professional shortfalls in a lot of fields.”

He suggested that one way to encourage students to consider higher education is to tackle the cost head-on. The Pell Grant program remains the federal government’s largest for undergraduates, but some lawmakers argue Congress must allocate more money.

“At the federal level, we have long advocated for restoring the purchasing power of the Pell Grant and making sure that it pays for as much higher education as it did when it was first enacted,” DeBaun said.

Despite the potential for long-term benefits, in a poll that Pew conducted at the end of 2023, just 22% agreed the price of a four-year degree is worth it, even if it means taking out loans.

ScholarshipInstitute.org

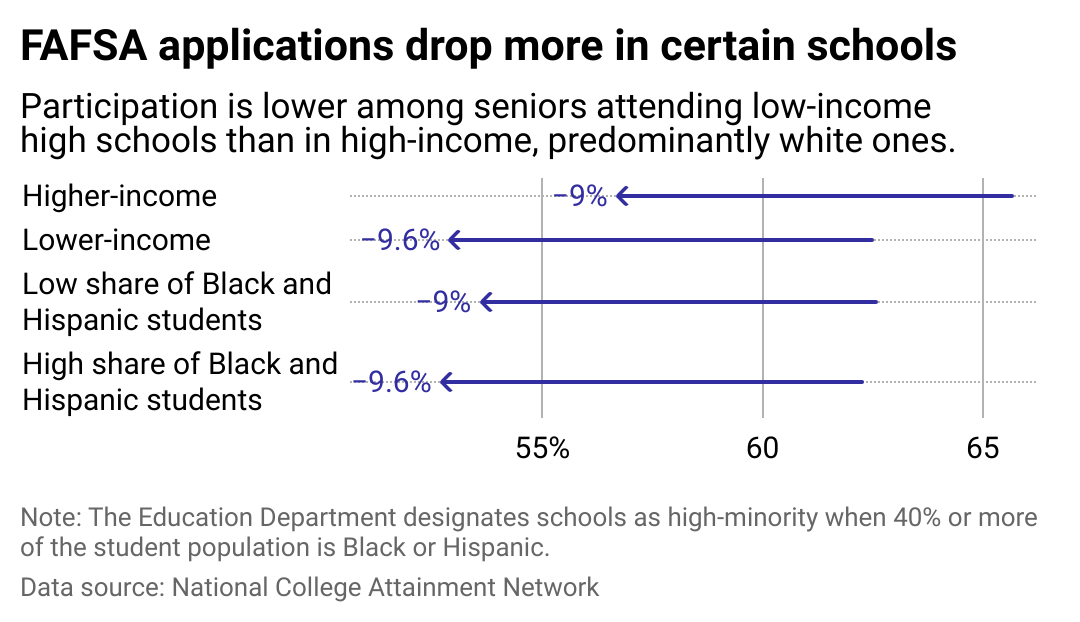

Some groups were more impacted than others

Lower-income schools and schools with a high share of Black and Hispanic students, which the Department of Education defines as 40% or more, were particularly affected by the bungled FAFSA rollout. A Century Foundation report found year-over-year dropoffs in FAFSA form completions at around 20% for these marginalized communities, a factor that will likely be mirrored in enrollment rates for these communities.

These students were also twice as likely to submit an incomplete FAFSA application. OneGoal, an organization that works with more than 13,000 students—many of whom are low-income or students of color—makes post-secondary aspirations more widely attainable through advising and support. Eighty percent of its students completed their FAFSA forms this year compared to 48% nationwide, according to an email to Stacker from Stephen Barker, a spokesperson for OneGoal.

The organization was also able to assist when the FAFSA debacle occurred.

“We worked with our students to stay in touch with their financial aid offices at their top schools to keep them updated on the status of their application and many were able to get extensions because these institutions understood that FAFSA was the problem,” Barker wrote.

He noted that FAFSA problems aside, students fail to apply for billions of dollars in available aid each year by not completing the FAFSA form. OneGoal’s success could be informative for others, so this aid reaches those who need it.

Another initiative intended to ensure all students have a chance at higher education is Common App, which offers a free admission application that people can use for more than 1,000 colleges and universities. The nonprofit aims to reach more low- and middle-income students and strives to help an additional 650,000 applicants from those communities by 2030.

“Whether it’s a global pandemic, FAFSA fiasco, or something else,” Barker said, “we have to better prepare our students, especially those who are first-generation or from low-income backgrounds, so that they can withstand these unforeseen challenges and find resilience in overcoming them.”

Story editing by Shanna Kelly. Additional editing by Kelly Glass. Copy editing by Kristen Wegrzyn.

This story originally appeared on ScholarshipInstitute.org and was produced and

distributed in partnership with Stacker Studio.